NFTs have sprinted through the hype cycle, from frenzied enthusiasm to disillusionment in less than 24 months. Signals are hinting that they may have reached the ultimate stage of the cycle: productivity.

The crypto winter chilled a large cohort of investors previously emboldened by a steady upward march in digital asset valuations. Bored Apes, secured by FTX-stored tokens sailed from their virtual yacht club to oblivion, as the celebrity-backed craze ran aground while the speculative NFT market plunged by 97 percent between January and November 2022, prompting a call for dropping the term ‘NFT,’ in favor of ‘digital collectibles.’ Since then, Bitcoin, Ethereum, a basketful of established cryptocurrencies, and even the Bored Ape NFTs have stabilized, although at greatly reduced valuations as speculation calms in digital finance, and the worthless investment vehicles dissolve. From this chill, green shoots of productivity for retail could be emerging as venture capital-backed technologists are repurposing NFTs and related blockchain-based technologies.

Retail NFT Pioneers

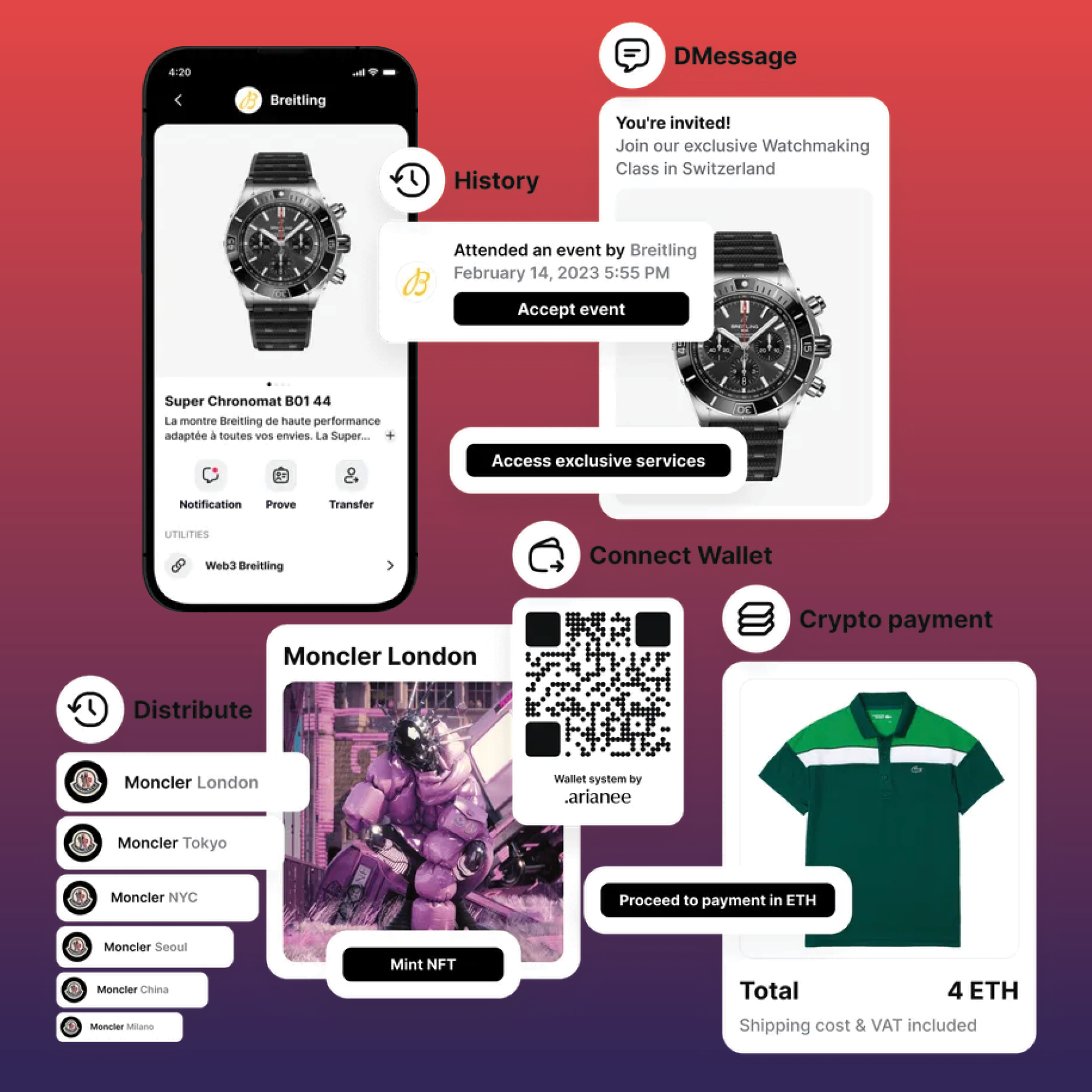

CEO of the NFT platform Arienee, Pierre-Nicholas Hurstel, spoke with The Robin Report at a recent trade show. He detailed the company’s partnership with exclusive watchmakers IWC and Breitling, for which it has created digital product IDs verifying provenance, product attributes, ownership history, warranties, etc. He continued, describing the platform as the next iteration of CRM, with loyalty programs, product drops, and exclusive access to events for verified owners. Hurstel exclaimed, “Finally, we have found the killer use case for NFTs.” Interest in the Arienee platform has expanded beyond watches as luxury and contemporary apparel brands and retailers, Moncler, Galleries Lafayette, Printemps and others have signed on.

Skeptics would take Hurstel’s projections with a grain of salt, but luxury houses LVMH, Cartier, and Prada seem to agree in principle. The industry leaders have created a consortium, building an alternative digital passport system similarly grounded in the blockchain. The Aura system uses RFID tags and NFC microchips (small, embedded chips that activate receivers in cell phones and devices, supporting mobile payment systems and other functions) attached to products during manufacturing to develop transferable, but tamper-proof digital ownership certificates. The luxury consortium, The Aura Blockchain, was established as a not-for-profit partnering with technology firms Microsoft and ConsenSys to reduce counterfeiting and support sustainability claims. The Aura blockchain allows for traceability, following products from raw materials through resale. The founding companies have been joined by Jil Sander, Marni, Bulgari, Maison Margiela, and others.

Recapturing Value

Resale continues its ascent, grabbing an ever-increasing portion of annual apparel spend. McKinsey projects that the secondary market will experience a 10-15 percent annual growth rate over the next decade. Luxury brands have been slow to capitalize on the trend, but that appears to be changing. Balenciaga quietly opened a resale platform nearly two years ago and recently, fully integrated resale into its ecommerce strategy. Coach (ReLoved), Oscar de la Renta (Encore), Isabel Marant (Vintage), and Gucci (Vault) among others, have established branded resale platforms, hoping to capture residual value. In an recent episode of The Debrief, BoF technology consultant Marc Bain opined on the role NFTs may play in the secondhand market as brands hope to deploy the digital tokens to generate resale royalties. Bain explored the benefits, challenges, and value capture of this strategy. While NFTs may prove beneficial to luxury resale, logic with imply that they are perhaps more useful in general resale platforms, eBay, The RealReal, Vestaire, etc., where product origin is less secure.

ESG and End-of-Product-Life Efficiencies

For businesses operating in the increasingly challenging regulatory environment, particularly in the E.U., digital passports may prove useful in demonstrating a brand’s progress in sustainability efforts, while also satisfying consumer expectations by demonstrating alignment with stated ESG goals. The Eon platform generates what it calls a CircularID. Working with Yoox Net-A-Porter, Target, PVH, Chloé and other companies, it connects products to supply chain information stored in the cloud. This information goes beyond informing consumers and regulators, it stores an item’s material breakdown data, facilitating sorting, recycling, or disposal. in addition to Eon, other ESG-oriented digital traceability platforms have emerged including Fibretrace which specifically monitors denim, and Circular Fashion which encourages a closed-loop apparel recycling system from garment design through recycling or end-of-garment-life.

Buyer Beware

Virtuous sustainability efforts and traceable technology offer both risks and benefits. Brands and designers duped by untrustworthy suppliers may have tainted ESG data immutably cemented in the blockchain, exposing the brand to credibility, regulatory, and safety risks. When considering any public-by-default initiative such as NFTs, or alternative blockchain-based systems, the benefits of transparency are countered by the costs of exposure. Trade secrets or proprietary supplier information will be publicly available in any transparency-based NFT or the underlying blockchain. Stored information can never be edited, obscured, or deleted. For retailers with less than airtight supply chains, the adage of garbage in, garbage out, becomes garbage in, garbage forever associated with your brand in the blockchain.

Who is the Winner?

Have we discovered the killer use case for NFTs in retail? Have NFTs achieved the productivity stage? Let’s examine the questions and weigh the implications.

- Watches, leather, faux leather, and other durable accessories are practical vehicles for NFC chips that unlock a link to the consumer. Designers and brands can use this customer touchpoint to incentivize end users to engage with attractive benefits.

- Garment traceability is trickier, if a customer removes a QR coded tag, the brand’s phigital(digital/physical) connection to the product is cut. NFC chips embedded in apparel are difficult to remove and counter sustainability options as they complicate recycling efforts. Traceability is a regulatory benefit for luxury brands, but a challenge for large retailers with unwieldy supply chains.

- Authentication benefits the resale market and the consumer, but will it benefit the brand or designer responsible for its implementation and the related expense? The incentives inherent in luring high-value goods away from owners to facilitate brand value recapture will by necessity be high. Consumers may instead choose general resale platforms, allowing them to sell authenticated goods directly through established resale channels and private networks.

- If luxury brands are successful in establishing resale channels, will that kill already struggling online resale platforms, reducing consumer choice, and limiting the upside for sellers?

- Will consumers agree to wear or carry products that are trackable?

I could go on with implications but I will stop here. NFTs are useful under certain conditions, but is retail the “Killer use case for NFTs?” Not to equivocate, but the answer is, it all depends. For luxury brands, yes. Authentication, digital ownership certificates, and supply chain visibility add value to high-ticket items, and unlock new customer engagement channels. In general consumption, brands should carefully explore the implications for their company and consumers. While NFTs may be a solution for specific brands, they are a solution in search of a problem for others. Retail is heterogeneous. It is a fool’s assumption that an app, or any technology is a panacea that will solve for a weak strategy or execution. The killer solution is adaptive and agile leadership and culture that addresses the problems to be solved, rather than outsourcing a remedy to technology.