In the July 2004 edition of The Robin Report I wrote a prophetic article titled, Pop-Ups: Not Just Ads — Do the Poppers Get It? The article explained that Target, along with other early pop-ups employed solely as a marketing tactic, were missing the much larger long-term strategic opportunity. At the time, 14 years ago, I opined that the retail industry was into what I defined as the \”third wave\” of distribution, which would require all consumer-facing businesses to re-think their distribution strategies and structures. This requirement was due to the market characteristics of the third wave, which were, (and still are), an enormously over-congested marketplace, therefore, overly-demanding consumers who, back then, were also beginning to understand the speed and convenience offered on the \”global freeway\” called the internet, and, of course now, are hopping on and off that freeway, 24/7.

Distribution Platforms

So, there are two types of distribution platforms in this wave: physical and digital. Yet, there are arguably thousands of different strategic uses of each. However, there is only one objective for both: to laser-distribute/deliver one\’s value (or be immediately assessable) to the precisely targeted consumer who desires it, preemptively (ahead of the multitude of equally compelling competitors), to precisely where, when, how and how often the consumer desires the value offering.

The mindset (or reset) required to understand, and more importantly, to implement this strategy, is to be able to focus on the consumer as the POS (point-of-sale), whether they are inside your physical platform, (formerly known as the store) or on the \”freeway\” (smartphones, tablets, PCs or voice devices).

So, what does this have to do with Amazon being the largest Pop-Up in the third wave? If we define Pop-Ups as a platform of opportunity, popping up in front of the consumer as the POS where they are and when they want the value, then we can metaphorically describe Amazon as the largest Pop-Up in wave three. Indeed, Jeff Bezos understood the strategic enormity of the digital distribution platform, literally popping up in front of billions of points-of-sale (consumers), wherever, whenever, however and so forth, 24/7. Furthermore, through the superior use of data analytics, each one of the billions of consumers\’ points-of-sale has a personalized curation of the goods each consumer desires and/or needs. Additionally, the third wave\’s largest Pop-Up is popping-up at an accelerated pace on physical distribution platforms: Whole Foods, Amazon Go, Amazon bookstores, Amazon 4-Star store on Kohl\’s distribution platform and other testing platforms.

Pioneering the Pop-Up

So, I\’m redefining Pop-Ups. From a marketing and testing strategy, they are now physical and digital platforms that go precisely where their consumers are. Kohl\’s is an early poster child of Pop-Ups. In the early 90s they focused their distribution strategy for their core (35 to 55-year old working mom) consumers who did not have the time to travel to and wade through the malls. So, they executed a neighborhood, off-mall, small store strategy: big parking lot, one floor, central checkout, all for easy and quick in-and-out, while their archrival, JC Penney was miles away from its consumers, anchored to the malls. It has been estimated that all during the 90s as Kohl\’s was expanding its fleet across the country, they stole some $10 billion in revenues from JC Penney.

And now, Target, Walmart, Nike, Nordstrom and yes, even Amazon, are popping up in neighborhoods where their time-starved consumers reside. Furthermore, they are also localizing their assortments, Kohl\’s included. This macro-strategy of personalization (arguably an over-used buzzword) is only going to accelerate as this third wave of hyper-competitive distribution demands of it.

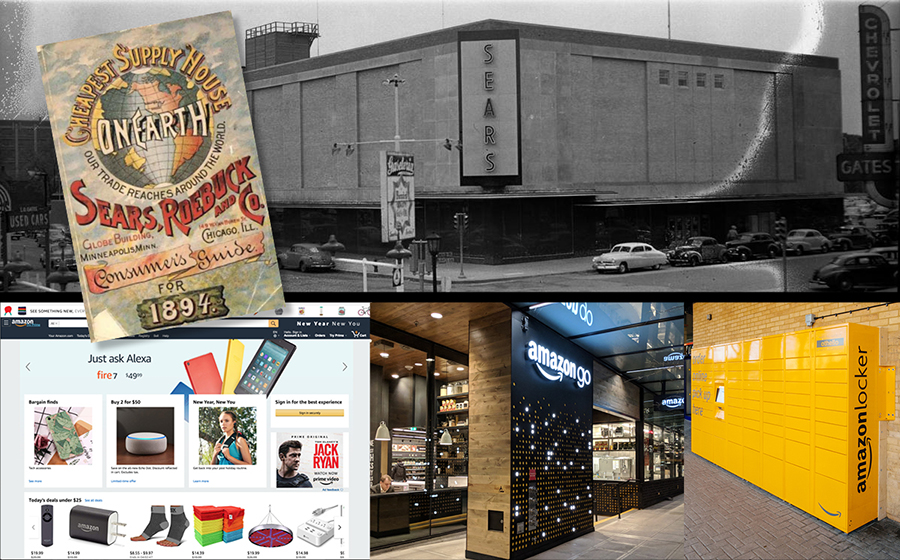

The First and Second Wave and Sears

In brief, our economy has evolved through a marketplace that was initially:

- 1. fragmented and dispersed, to

- 2. consolidated and mass, to our current landscape which is

- 3. consolidated and fragmented.

It\’s the necessity of huge, consolidated businesses leveraging economies of scale, productivity and velocity in the back-end of their supply chains, with fragmented product or branding \”cells\” on the front-end to be able to serve the ever more fragmented consumer marketplace. Such fragmentation is also compelling a wave of entrepreneurs, many of them millennials, to launch innovative, tech-driven niche businesses.

Wave One: A Fragmented, Dispersed Market

In the late 19th and early 20th centuries up until WWII, the consumer marketplace in the U.S. was very fragmented and dispersed. There did not exist a mass market, due to the fact that we were a nation of scattered towns and cities and largely a rural population. More significantly, our communications and transportation infrastructures were sparse and ill-equipped to amass consumer markets for buying, selling or distribution efficiencies.

Therefore, the prevalent retail and vendor models, indeed all business models, were equally fragmented and dispersed. It was the era of the small general store – leading to the early beginning of the department store. Consumers hoped to find everything they might need in these stores. However, while these thousands of small stores were scattered throughout the country, they were still difficult for many rural consumers to get to and one store couldn\’t possibly carry all of life\’s necessities.

Enter the Amazon of the wave one era: Sears Roebuck & Co. Its visionary founders understood distribution\’s first wave. Sears famous catalogue responded to the fragmented and widely dispersed marketplace, essentially following the consumer (as the point of sale) and putting their store into their living rooms, where the entire family would pour through hundreds of pages of products, offering everything from the baby\’s cradle to the ultimate coffin. Even prefabricated homes could be bought through the catalogue.

Wave Two: A Consolidated Mass Market

Post-WWII U.S. was characterized by explosive growth, including the rapidly evolving communications and transportation infrastructures. The population moved from the farms and rural areas to the cities and newly developing suburbs, following job opportunities. Therefore, the marketplace was aggregating and forming a national mass market, largely homogenous in its characteristics with common desires for similar products. Of course, this marketplace shift was facilitated by the construction of our enormous highway system, corresponding growth in transportation of all types, including the explosive growth in automobiles, and burgeoning national media and communications networks.

Since the widely dispersed, small business structure of wave one became inefficient and ineffective for serving the newly emerging mass markets, businesses began to consolidate, forming huge companies able to more efficiently leverage back-end operations, logistics and other supply chain functions.

They were also better able to more effectively leverage the front-end marketing requirements to serve the masses.

And guess what? Again, the Amazon of wave two would be Sears. They mirrored the shifting consumer markets, and again, Sear\’s leadership had the visionary understanding of distribution\’s second wave. Sears followed the consumer to the suburbs and literally built and anchored the early shopping malls, many of which they (unfortunately) still anchor (or more apt, are anchored to) to this day. Sears literally invented the mall concept.

This was truly the retailing era when one could \”build-it-and-they will-come,\” and the masses did.

Wave Three: Consolidated and Fragmented: Markets as Individuals

We are currently in distribution\’s third wave. Many retailers and other consumer-facing businesses of all types understand and sense it, or are randomly reacting to it when the dynamics of business force them to do so. Some don\’t understand this wave and are not even reacting to it. They are metaphorically not \”catching the wave\” and will surely drown.

This wave is primarily characterized, not by major population shifts, but by consumers\’ shift in demands and elevated expectations, both hugely empowered by the internet and e-commerce. As the consolidated giants of wave two battled each other for share of the same consumer\’s wallet and bestowed ever more and better product and service choices on the consumer, eventually the power of unlimited and instantaneous selection turned into the power of unlimited demands for ever-greater value, including convenient accessibility and for rock-bottom prices.

Third wave consumers are also no longer homogenous. They don\’t have to be with every business fighting tooth-and-nail to please them. Therefore, the marketplace is back to being fragmented and dispersed, indeed, individuals as the points-of-sale, wherever they are. And as night follows day, the highly sophisticated communications, transportation and technological systems of wave two that worked to market to the so-called mass market, no longer work.

And of course, what else no longer works? The build-it-and-they-will- come, big labyrinth of department stores and shopping malls which require consumers to travel to, and then wade through, in this era of time being the new luxury.

What Will Third Wave Distribution Success Look Like?

What will work to serve this new third wave market is the continuing consolidation on the backend of businesses, for all the obvious reasons mentioned above, but with an equally aggressive fragmentation on the front end (marketing, branding, distribution (localization and personalization).

For the major legacy retailers, fragmented front end would look like something mentioned above: a fleet of small, neighborhood, localized and personalized store models, such as Target, Walmart, Nordstrom and Kohl\’s, (continuing to pursue). Major brands including The North Face, Vans, Ulta, Urban Outfitters and many others will accelerate their direct-to-consumer models, locating where their consumers reside as well as personalizing/localizing their assortments. And the diminishing wholesale business will be on the retail platforms of their choice. They will lease space from those retailers and will control all of the operations, including the inventory. Likewise, their once big retail partners will continue accelerating their own private brands.

The long tail theory is also playing out across consumer-facing industries. Massive existing businesses like Walmart are building a long tail of small niche businesses like Bonobos, Moosejaw, Modcloth.com, Eloqui and Shoebuy.com, along with Jet.com\’s earlier acquisition of Hayneedle.com will continue.

Another model, launched by Macy\’s in their Manhattan flagship, called The Market@ Macy\’s, provides space for pop-up brands, cycled out and replaced with new brands every few weeks. An added benefit for Macy\’s is increased traffic exploring the new brands.

And as mentioned above, there will continue to be a tsunami of small, back-to-the-future intimate, personal, entrepreneurial shops, brands, services and whatever. Many (maybe most) will be tech-driven, launched by the next-gen culture.

Of course, all digital and physical platforms will be seamlessly integrated to the point where consumer-facing businesses will not refer to online or offline operations as separate. Both will be unified.

And finally, the entire marketplace (digital and physical platforms) will be democratized. Just as Amazon is succeeding in providing a global platform for anybody with everything you can imagine from the lowest priced staple and luxury goods to food and home services. Walmart will also evolve to the same model. Indeed, all major distribution platforms have the potential to achieve this kind of breadth and depth of consumer offerings because technology and the consumer make it possible.

When consumers need or want something, regardless of what it is, they first go to Amazon, because so far, it\’s the biggest and closest Pop-Up for all consumers. The Amazon brand stands for convenience, speed and value (not just lowest price). So, all consumers across all demographics feel welcome, just as they did in the first wave with the thousands of pages and products in the Sears catalogue.

This is distribution\’s third wave. And you better catch it and ride it to success, or you may very well drown, not unlike the fate of Eddie \”missed the third wave\” Lampert.