Did the Pandemic Change Retailing Dramatically?

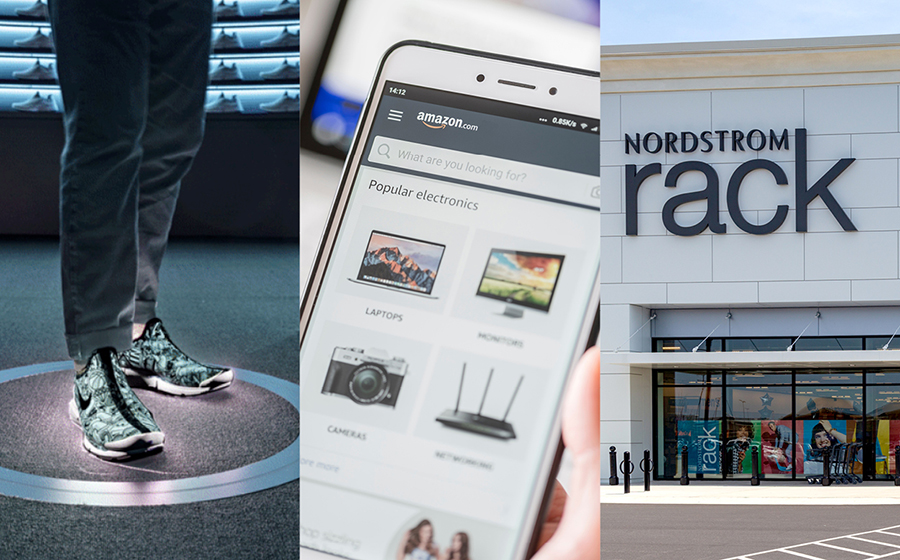

Any professional observer of retail trends and every shopper in the U.S. would tell you that retailing, and retailers changed dramatically during the pandemic. But many of those changes were already in the works before the pandemic even started. One of […]

Did the Pandemic Change Retailing Dramatically? Read More »