Layaway as we know it has changed considerably over time, and it seems antiquated when today\’s millennials are looking for higher levels of instant gratification than consumers of the past. As such, there has been a rise in the buy-now, wear-now, pay-later tech-enabled business model where shoppers can take home their purchases immediately, while paying in instalments.

In the past, retailers would have the burden of storing layaway inventory until the customer had the funds to pay it off. Once the item was completely paid for, the customer was allowed to pick up the product. The retailer\’s issue was that they had to incur the costs, logistics and space to hold layaway merchandise. On the consumer side, shoppers had to wait to use their product by saving up enough money before making the final purchase. Then they had to make a second trip to the store to pick up the purchase.

But with buy-now, wear-now, pay-later, the customer takes the product with them at the point of transaction and e-com goods are sent at the transaction point. The big win for retailers is they don\’t have to figure out where to store layaway goods, deal with customers who change their minds and handle the mound of abandoned product.

As retailers and brands desire to capture the hearts, minds and wallets of millennial and Gen Z generations, understanding what drives their decision-making is critical. Connecting through a social cause, giving a voice in the development of a product and empowering customers with alternative interest-free payments that are convenient and simple to use are touchstones that resonate with the next gen.

Forerunner

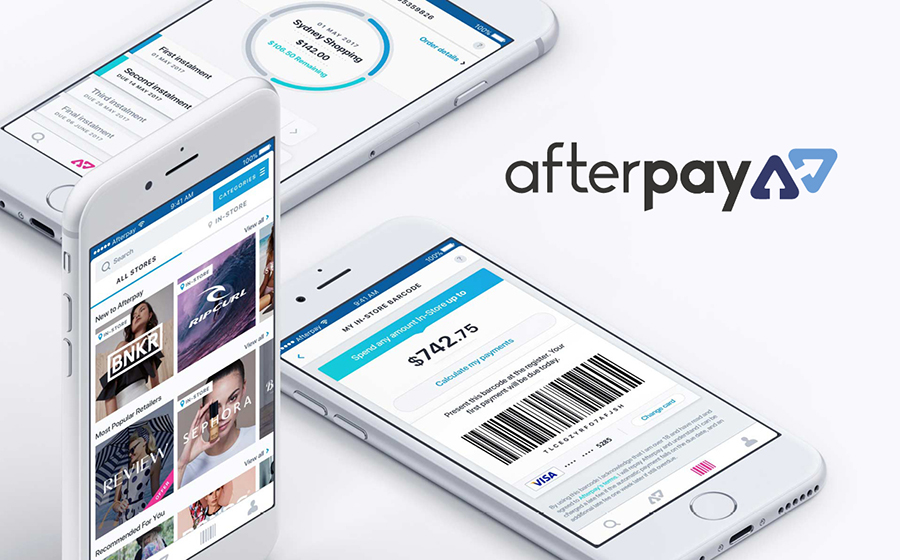

The pioneer in the buy-now, wear-now, pay-later space is a company called Afterpay, which has had resounding success in Australia, where it was founded. Recently, Afterpay launched here in the U.S. with the millennial-loved brand Urban Outfitters. Now Afterpay has over 17,000 retailers including some of the most innovative brands in the U.S. landscape including Rebecca Minkoff, Cynthia Rowley, Quay, Morphe, and deborah lippman.

CEO and Founder Nick Molar, explains why Afterpay resonates so greatly with the millennial market, \”Saddled with the burden of student loans and the memory of financial hardship from the 2008 recession, millennials want a new and better way to pay. Afterpay offers a payment solution for the millennial mindset allowing shoppers to budget and achieve their lifestyle goals in a responsible and life-affirming manner. \”

Made for Millennials

Jasmine Glasheen, a Generational Marketing Expert at Vend, agrees. \”Millennials are uniquely attuned to the threat of debt. When you consider that we lived through a recession and are still paying off our student loans, it should come as no surprise that Gen Y is less likely to opt into the additional charges that come with using credit cards. This is why buy- now, pay-later solutions are so appealing. We can pay for products as we make the money, with no threat of growing charges over the long term.\”

Afterpay has demonstrated proven results with a 90 percent repeat customer rate, 22 percent average conversion uplifts and 20-40 percent increase in average order value.

Debt Management

The technology has advanced over the past few years, allowing for ease of synchronization with retail partners and is intuitively easy to use from a customer perspective. The software can be used online, in-store or on mobile platforms and allows customers to pay for purchases in four equal instalments over four weeks.

The consumer market is shifting and millennials will constitute fifty percent of all consumer spending in the U.S. by 2025. According to the Federal Reserve, 63 percent of millennials do not own a credit card which means in the next seven years, nearly two thirds of consumer transactions may not involve a credit card.

Customers love the model because they can use the products immediately and not go into large debt by paying off the total amount instantly. Unlike credit cards, there is zero interest or fees for customers who pay off on time and the debt does not build up since the total must be paid off before future purchases can be made. This keeps the customers out of debt and provides them the products at the point-of-sale.

Market Entrants

There are other companies that have followed Afterpay\’s lead. Sezzle, for example, offers a similar product and is now an option on thousands of sites. According to Co-Founder and CRO Paul Paradis, \”E-commerce sellers should work with Sezzle because young consumers today don\’t have access to credit like previous generations did, and their purchasing power is suffering as a result. Sezzle enables these shoppers to budget purchases over time with interest-free installment plans, increasing their purchasing power without posing the same financial barriers and pitfalls that credit cards do. Sezzle is being used by over 3,000 online merchants today, increasing sales by 10 percent, basket sizes by 20 percent and purchase frequency by 40 percent.\”

Retailers should be aware that while Afterpay and Sezzle offer comparable products with a small percent charged to the retailer for use of the service, there are other companies in the market that offer loan-type payment plans. For example, Affirm charges interest to the customer and the pay-off period is longer.

Retailers that want to embrace the millennial and Gen Z markets should consider offering buy-now, wear-now, pay-later payment options for their online, in-store and mobile transactions. This is particularly important during the holiday season when average order values with companies like Afterpay have increased between 20-40 percent. Selling inventory now versus later helps with improving profit margins, reducing markdowns and increasing inventory turnover leaving less stock for post-holiday.

Layaway may be on the way out, but tech-enabled buy-now, wear-now, pay-later is on rise! Is your retail business keeping up with consumer demand?