Articles in

Opinion

True Crime Retail Podcast

Kate Newlin

February 13, 2024

There was a time we could still envision when going to the mall used to be a joyous activity. Even an aspirational one. Even a ...

Read More →

Where Is Black Leadership in Corporate Retail?

Mikelya Fournier

August 9, 2023

Over the next 50 years, Nielsen research predicts the Black population is expected to grow by 22 percent while the White (non-Hispanic) population is expected ...

Read More →

Target’s Big Fail

Arick Wierson

May 31, 2023

In today’s world, where corporate responsibility, culture wars, and social progress are more or less bound to become intertwined strands of any major national discussion, ...

Read More →

Just Adding Home Won’t Make Banana Republic a Lifestyle Brand

Pam Danziger

April 25, 2023

Banana Republic is a brand with a mission: to build a brand with character and a personality that truly resonates with customers. It had that ...

Read More →

Undertaker Eddie: It’s Done. It’s Over. R.I.P.

Robin Lewis

April 5, 2023

With all due respect, after two decades of my tracking Eddie Lampert’s brilliant financially engineered demise of Sears and Kmart, while he personally pocketed a ...

Read More →

Cautionary Tales of Big Tech and Your Business

Deborah Patton

March 6, 2023

Let’s take a pause. Have you been keeping track of the tech news? We’re entering a new phase of our obsession with technology and its ...

Read More →

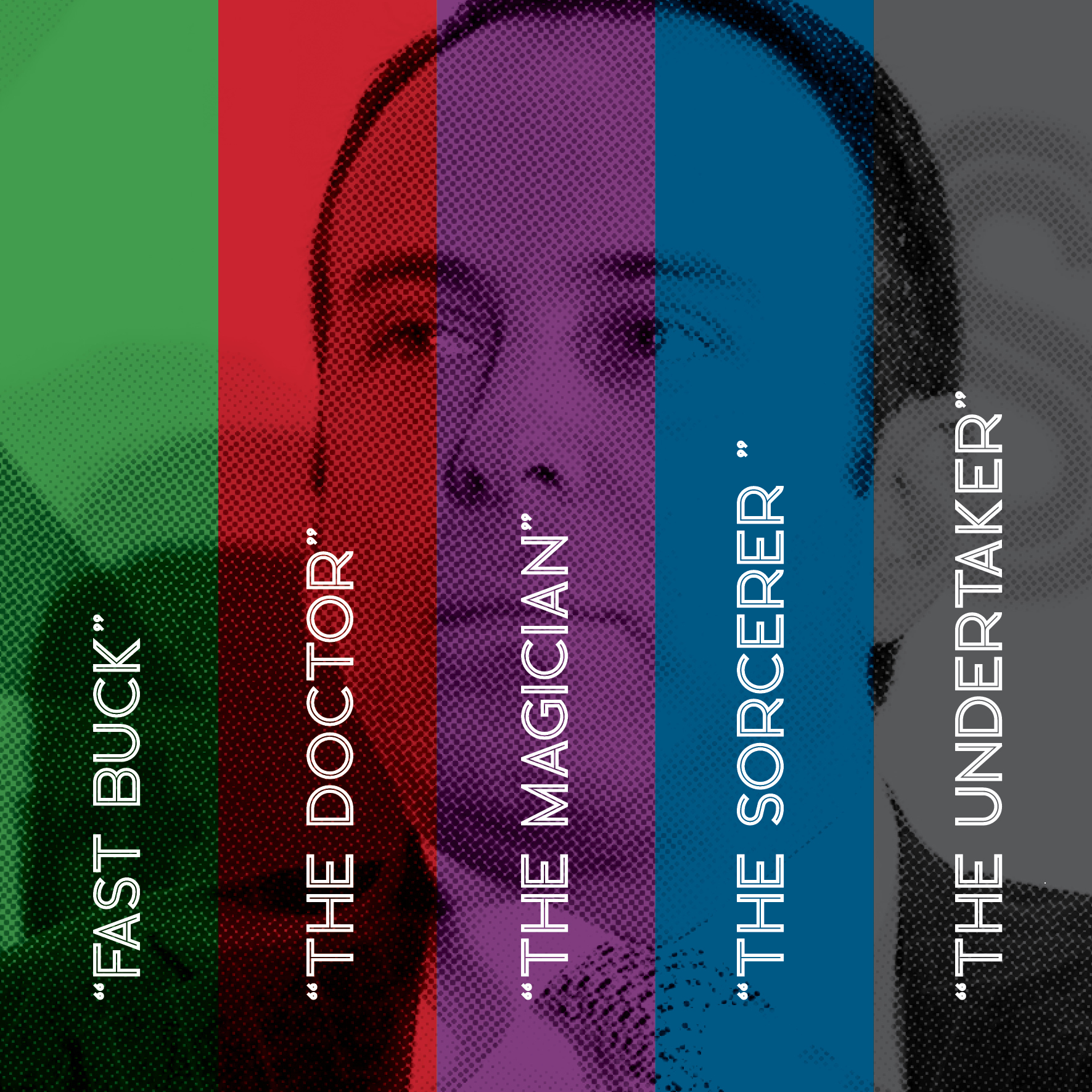

What Do Zuckerberg, Musk and SBF (Who?) Have in Common?

Robin Lewis

November 16, 2022

Zuck, Musk and SBF: What do these entrepreneurs have in common? A large dose of hubris, ultimately soaring to failure. And they are not alone. ...

Read More →

Retail Could Have Been a Game Changer at CGI

Arick Wierson

October 3, 2022

Some use the moniker ‘Davos-on-Hudson’ to describe the Clinton Global Initiative – better known colloquially as ‘CGI’ by global movers and shakers. But no matter ...

Read More →