Although they say they don’t care about conformity, next-gen consumers sure are thirsty for access to hot ticket brands. H&M is the latest online fashion retailer to heed the call by hosting competing brands on its online marketplaces. Over 13 womenswear labels and 15 menswear labels will be added to nearly 20 existing labels in H&M’s ever-expanding brand portfolio. The rollout is starting in Sweden and Germany, with intent to penetrate into more of the brand’s 54 existing online markets.

So, why the rapacious pace of acquisition? A whopping 66 percent of customers prefer to shop at online marketplaces rather than individual brands. For context, Amazon and Walmart surpassed 100,000 sellers on their online marketplaces back in 2021, while H&M is still closing in on 40. Online marketplaces aren’t an arena that brands and retailers can afford to overlook, as nearly half (48 percent) of online shoppers go straight to a marketplace to do their thing.

Increased revenue is the #1 benefit of selling on an online marketplace. Brands that sell on a single online marketplace see a 190 percent jump in revenue over those that sell on just one channel. But that’s not all. Brands using online marketplaces also benefit from all of the consumer trust from the marketplace they’re selling on.

Core Advantages of Building an Online Marketplace

Increased revenue is the #1 benefit of selling on an online marketplace. Brands that sell on a single online marketplace see a 190 percent jump in revenue over those that sell on just one channel. But that’s not all. Brands using online marketplaces also benefit from all of the consumer trust from the marketplace they’re selling on. This is great for young upstart brands who don’t have the advertising, funds or time to build a reputation.

Potential market domination is the most obvious selling point to creating your own online marketplace. Once you become known as the destination for everything, purchasing becomes automatic. With that said, apparel customers tend to be a little bit more finicky. But if the #1 online behemoth is able to reap market share with all of the negative press, shipping delays, and worker shortages, it makes sense that more retailers are throwing their hat in the ring.

The leading online marketplaces in the U.S. are Amazon, eBay, Walmart, Etsy, and Target, respectively. To put the current success of online marketplace sales into context, Amazon’s online sales now comprise 34.5 percent of all ecommerce fashion sales. Amazon has been building up their private label offering in addition to hosting competing brands. For every item sold on Amazon, the marketplace takes a referral fee that falls somewhere between 8 to 15 percent.

The Other Side of the Coin

Marketplaces grew at 2x the rate of general ecommerce growth last year. But it isn’t all roses and butterflies. As H&M will soon learn, hosting competing brands can get dramatic – and litigious – very quickly. Just take a look at online free marketplaces OfferUp and LetGo, which are being sued after a “verified seller” gunned down two parents of five children who were trying to purchase a SUV for their family. All you need is an email address to become verified on these platforms, which critics argues isn’t enough due diligence to call someone a “verified seller.” So, as you can see, providing customer security is as essential to the longevity of an online marketplace, even a free goods exchange marketplace like LetGo or OfferUp. Customer expectations are even higher when there’s money being exchanged for goods.

Beyond protecting consumer safety, by properly vetting verified sellers and homing in on counterfeiters, marketplace hosts are also accountable for ensuring they offer competitive prices on all of the products being sold on their platform. This has gotten a lot harder recently. The annual inflation rate for the United States is the highest it has been since January 1982, coming in at 7.9 percent for the 12-month period ending in February 2022.

Price is currently a differentiator for many customers out of necessity. But this doesn’t mean they’ve abandoned their values. Today’s customers are searching for the best brands, with the most feel-good ethos, at the most affordable price points, with acceptable shipping and customer service timeframes. When they can’t have it all, many will settle for low prices and fast shipping on CPG. Apparel purchases, on the other hand, are more ethos and excitement driven.

Legacy Brands Lend Credence to Online Marketplaces

Variety is the spice of life, but legacy brands give customers something even better – a product they can trust. A few things happen when a legacy brand like Crocs or Levi’s partners with an online marketplace. The marketplace benefits from the brand’s built-in customer base and it’s elevated by the brand’s presence; whereas the brand is exposed to a new sales funnel, a new customer demographic, and may be able to establish a presence in areas that the company’s current shipping network doesn’t allow.

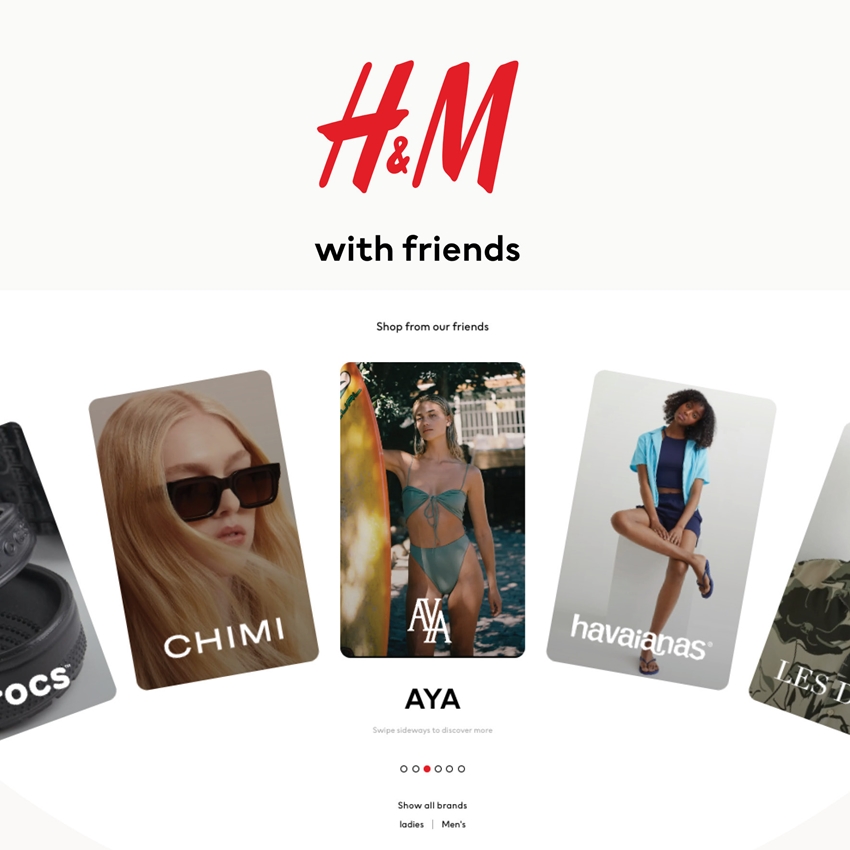

H&M is all over this trend, as it puts the company on a fast track to establish lasting notoriety well beyond the current demand for fast fashion. Labels currently hosted under “H&M with Friends” include easily identifiable classic denim labels like Lee and Wrangler. You’ll also find heavy hitters like Fila, Superdry, Crocs, Kangol, and Buffalo.

While this strategy makes sense for a fast fashion giant like H&M, not every brand is cut out to be its own marketplace. Most don’t have the necessary shipping infrastructure in place, or the resources to hire an active customer service team. Expanding into an online marketplace should always be part of a strategy to increase customer satisfaction, rather than just growing for growth’s sake.

In Closing

It’s all about strategy. Any brands a retailer takes on need not only to fit with the existing brand image, but also offer customers something that the brand’s inventory doesn’t provide. Until you get to megalith status, à la Amazon and Walmart, there’s no excuse to host brands that compete with your private label inventory. Start by creating partnerships that bridge the gaps in your existing offerings, then watch as your brand presence evolves.