When New York magazine’s Grub Street newsletter recently asked the question, “Why does every store suddenly look the same?” It was using the term “Shoppy Shops” to describe the look-alike trend for artisanal brands. But the question came as little surprise to anyone in the business.

The homogenization of what we call “artisanal market” stores selling consumer product goods and other niche products for the home has been an ongoing trend for some time. What’s changed more recently is the way that process has accelerated, largely due to shifts in the wholesale buying network that makes it easier – read “less difficult” – to access specialized products.

The inevitable question for specialty retailers is when does a small niche brand that makes your store, well, special, become so widespread that you probably shouldn’t be carrying it anymore?

A combination of fewer regional wholesale B2B markets and trade shows with more online buying services means that brands and products that were once difficult to track down, much less buy, are now much more accessible. You can throw in social media as a news source for finding these products too. Then add in the strategies on the part of some of these brands – many of which are relatively new startups who are targeting design-oriented boutiques – and it all starts to make sense.

Symbiotic, Watson

“There is kind of a symbiotic relationship between these modern brands and the curated shops that carry them,” Grub Street quoted Neil Shankar, a designer for Block Inc., (which used to be called Square) that handles payment services for small retailers. Shankar, who the article credits with coming up with the shoppy shops label, said, “There didn’t seem to be a name for these artisanal markets that are popping up that carry these brands.”

Among the artisanal products mentioned in the article are Graza olive oil, Fishwife fish packaged in small tins, Omsom cookware and Diaspora spices. Many of these brands were initially targeted at online shoppers, often through social media, but like many larger direct-to-consumer products like Warby Parker eyeglasses and Casper mattresses, they moved to sell in physical stores where the lower customer acquisition costs and better payoff in sales have combined to make the business model more successful.

But it’s the process in the way this has happened for artisanal brands that has really been the gamechanger. In the past, independent retailers – large ones to a lesser extent – were able to place their wholesale orders on an entire network of local and regional markets, rather than at enormous shows that were national in scope. These shows, in smaller and mid-sized cities like Denver, Minneapolis, San Francisco, Boston and Seattle, often featured suppliers who only sold into limited geographic areas.

That has changed over the past decade and now for the gift and home trade, many of those local shows have disappeared. The biggest show, held twice yearly in Atlanta at the AmericasMart facility, has become the national marketplace and regional shows have been reduced to events in Dallas, Las Vegas, and New York. The High Point furniture market remains the main location to buy larger home furnishings products like furniture. The assimilation in allied industries, like fancy foods and kitchenwares, have coalesced around the Inspired Home Show in Chicago every March.

Duh, It’s the Faire Disruption

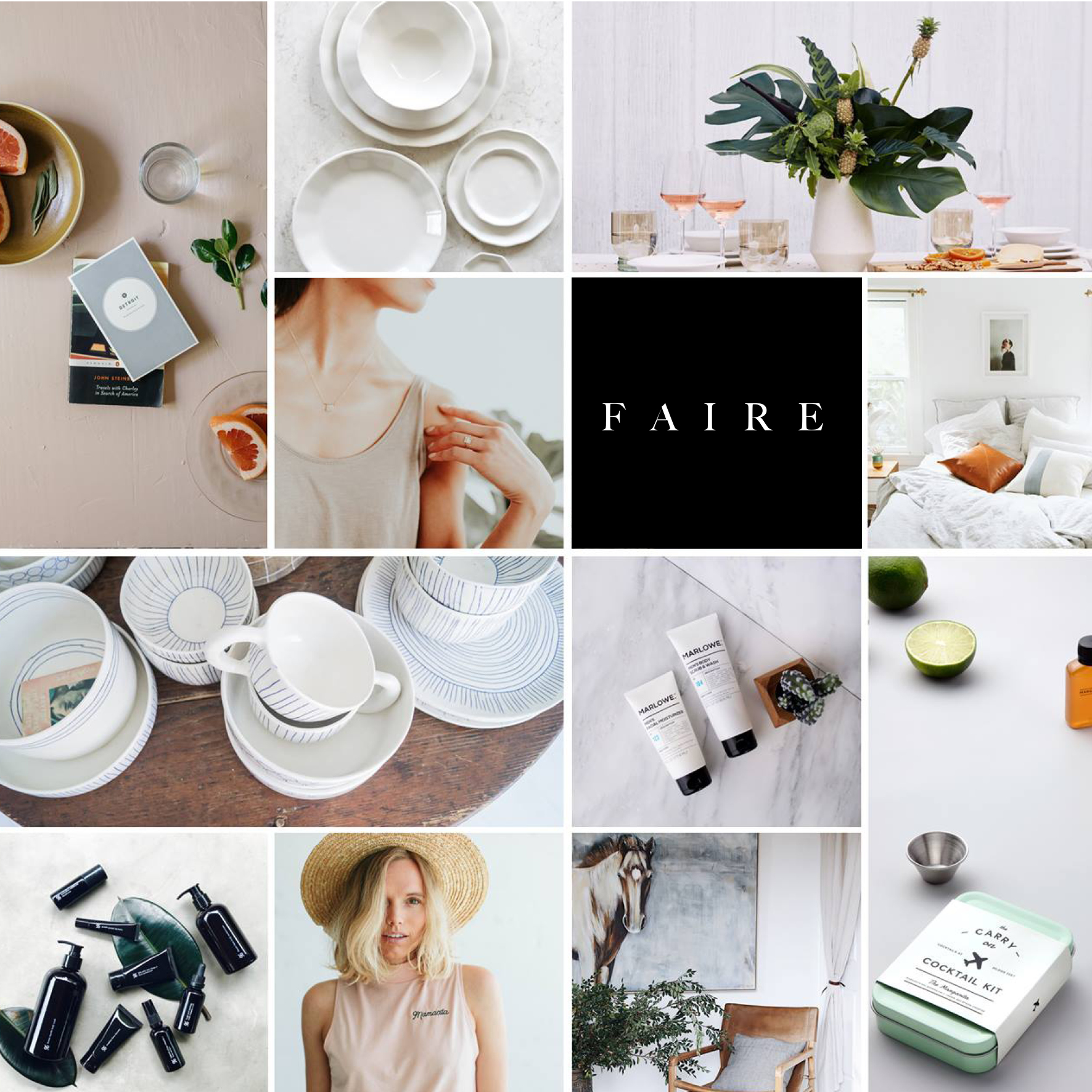

But the big disrupter, as it’s been in so much commerce, has been the internet and online B2B marketplaces where independent retailers have access to virtually any supplier in the country…and the world. None has been more of a factor than Faire, which began several years ago and after a series of rounds of tech-industry-fused financing is now valued at $12 billion.

It offers a number of inducements from free shipping to free returns and has captured a significant share of the digital market space, growing by 130 percent year-over-year according to a quote from the company’s CFO in the Grub Street article. Competing digital marketplaces from both physical trade show operators and third-party platforms have not had nearly the success as Faire has achieved, but in the aggregate, they have made the ordering of niche and specialized products significantly easier for local independent retailers. Thus, the ubiquity of artisanal brands in a surprising range of different retail stores.

These products are not just limited to specialty shops and boutiques. Many of these items can be found in larger chains like Whole Foods and one vendor quoted in the Grub Street article said he’d love to see his olive oil in a store like Walmart. “Look, we’re not shy about saying our goal is to get this product into as many people’s hands as possible,” it quotes Graza COO Allen Dushi. “We’re a ‘small business’ because our business is small. We would love to be a bigger business.”

All of which raises the inevitable question for specialty retailers: when does a small niche brand that makes your store, well, special, become so widespread that you probably shouldn’t be carrying it anymore? You also have to question the strategy of developing a niche brand that is sought after for its artisanal uniqueness becoming a headliner in a big box store. Just look what has happened to architecture. The New York Times recently ran an article headlined “America, the Bland” about the sameness besetting the country’s multi-family housing developments, taking what was once a cutting-edge design model and making it the defacto standard for much of the country.

The same thing seems to be happening in these consumer product categories. All this tinned fish, tech-inspired cookware, and olive oil in clever squeeze bottles can be found in stores across the shopping landscape. If every store in every hip neighborhood is carrying the same merchandise what’s so special about that?

Ubiquity can be a bitch. Especially for artisanal and crafts products that are banking on scarcity as a point of differentiation. That entrepreneurial spirit is likely to become collateral damage when a brand becomes commonplace.