While I’m sure it was just the way it all shook out, there are only men – seven of them, in fact — quoted in the mid-November official press release announcing the acquisition of Tom Ford by Estée Lauder Companies.

Building the Empire

In order, they are Fabrizio Freda, EL Cos. president and CEO; Ford himself; Domenico De Sole, co-founder and chairman, Tom Ford International; William Lauder, executive chairman, EL Cos.; Guillaume Jesel, president, luxury business development, EL Cos.; Ermenegildo “Gildo” Zegna, CEO, Ermenegildo Zegna Group, which licenses Ford’s menswear and is expected to pick up all pieces of the fashion puzzle, including women’s, moving forward; and Fabrizio Curci, CEO of Marcolin S.p.A., which licenses Ford’s eyewear.

What does Lauder know about apparel and accessories? Rest assured that, for now at least, the publicly traded cosmetics giant is very much staying in its lane by keeping the Ford brand’s longstanding relationships with Zegna and Marcolin in place.

Yes, even the eyewear guy got his say in the Lauder acquisition press release. Have you ever seen Ford without his trademark aviators? He sports the classic sunglass style even more than a certain current resident of 1600 Pennsylvania Avenue.

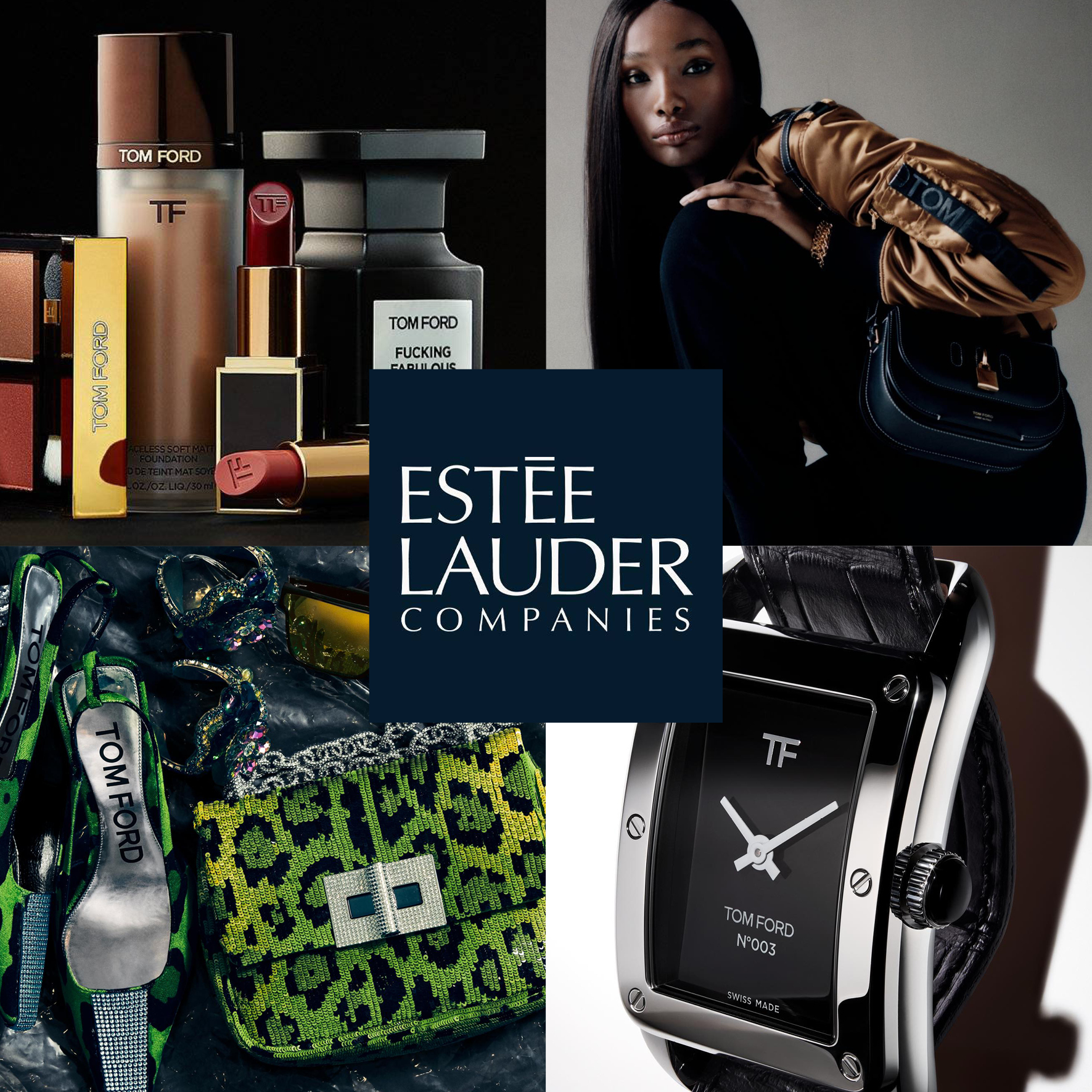

But back to this “no women” thing. The last time I looked, the bulk of Ford’s makeup, skincare and fragrances – not to mention a sizeable chunk of his ready to wear and accessories – are scooped up by women. I also seem to recall that the first two presidents of Tom Ford Beauty were industry veterans Andrea Robinson and Caroline Geerlings. But I guess that was way back in the initial getting-off-the-ground years for the brand. Ever since Tom Ford Beauty took off like a rocket, striking gold with juggernaut scents like the provocatively named Fucking Fabulous, Rose Prick and Lost Cherry, it’s been a big ol’ boys club.

And for Lauder, Tom Ford Beauty has proved to be not only buzzy and profitable, but eventually its entrée into two entirely new sectors: luxury apparel and accessories. After all, if your goal is to be the next Kering or LVMH, you have to take the plunge and snap up your first fashion brand.

The Biggest Luxury Deal of 2022

The Tom Ford transaction, in which Lauder plunked down $2.3 billion through a combination of cash, debt and $300 million in deferred payments, is considered the biggest luxury deal of 2022 by a sizeable margin.

And if your first question is, “What does Lauder know about apparel and accessories?”, rest assured that, for now at least, the publicly traded cosmetics giant is very much staying in its lane by keeping the Ford brand’s longstanding relationships with Zegna and Marcolin in place. Why rock the boat when said boat has been, thus far, watertight?

From my perspective, I don’t think this move signals that Lauder in fact does want to become the next Kering or LVMH. After all, fashion brands go off the rails all the time. In the past few months alone we’ve seen the Adidas / Ye West alliance blow up pretty spectacularly over the rapper mogul’s antisemitism, and as I write this, Balenciaga is reeling from a whopper of a situation attached to its BDSM teddy bear campaign.

Lipstick and eye shadow don’t typically get you into messes like that, although Lauder was put through the ringer by Brandon Truaxe, the volatile founder of The Ordinary, a cult skincare brand it bought a stake in circa 2017. Though Truaxe committed suicide in 2019 at age 40, Lauder bought Deciem, the parent company of The Ordinary, lock, stock and barrel in 2022. (Want a refresher course on the Deciem debacle? Go here.)

Tiptoeing Out onto Fashion Turf

While I’m never short on opinions about my beloved beauty beat, I don’t actually possess a crystal ball telling me whether this shiny new toy Lauder has acquired is signaling the start of a bold new direction for the company.

I could easily see this as a test case of sorts. Translation: If it works, and Lauder finds it relatively hassle-free and profitable to interact with Zegna and Marcolin, that could whet its appetite for acquiring other fashion brands.

What I do know for sure is this: Lauder is extraordinarily disciplined and intentional in every venture it undertakes. And while it certainly has taken plenty of risks over the past decade, aggressively acquiring brands that have and have not panned out in damn near equal measure, there’s an army of grownups at the helm that knows how to course-correct when trouble starts brewing.

But that’s the problem with fashion, isn’t it? Trouble is always brewing. Especially now, when consumers are wildly vocal when they feel a brand or a designer has put a foot in the wrong place. It’s very, very hard to manage all that, particularly when it’s not just a potential landmine designer (see: Ye West) but an entire creative team that signs off on a highly offensive ad campaign (see: Balenciaga). Lauder may not have the stomach for all that risk and exposure.

Betting the Farm on Beauty

So, if according to my theory, Lauder doesn’t have a true, burning desire to pivot to fashion, why buy Tom Ford outright?

To hang onto Tom Ford Beauty, of course. If Kering, which was reportedly one of Ford’s most ardent suitors, bought the apparel and accessories businesses, wouldn’t it want the beauty, too? Of course it would. It already sells beauty through its Gucci, Saint Laurent and Boucheron brands. And although Lauder launched Tom Ford Beauty, and made it what it is today, that license was set to expire in 2030.

From the get-go, Tom Ford Beauty, which made its debut in 2006, has stood out for its glamour, gorgeous packaging, and from slightly out of nowhere, its utter dominance in fragrance. Who knew Tom Ford was such an incredible nose? Sure, the guy seems to have the Midas touch with everything he dives into, be it resuscitating a moribund Gucci or Saint Laurent or directing stellar films starring Colin Firth, but his ultra-sure hand with scent creation has been pure money in the bank for Lauder.

According to a profile on The Perfume Society website, Ford works extraordinarily closely with the perfumers developing his scents and has said he considers fragrance more “important” personally, than great clothes and fancy furniture. While he could live without the first two, he claims he’d be hard-pressed to enjoy life without his favorite scents.

How perfect then, for Lauder, that they just locked in this fan-favorite, scent-driven beauty brand in perpetuity? It’s especially fortuitous since the fragrance category has been on fire since the pandemic and shows no signs of slowing down anytime in the near future. From oldies but goodies like Black Orchid and Violet Blonde to the more recent Ébené Fume and Santal Blush, Ford’s massive, influential and largely unisex scent collection is the gift that promises to keep on giving.

Yes, Ford (as well as De Sole, his co-visionary since the dawn of the Gucci era) will step down at the end of 2023, probably some six months after the ink is fully dry on the Lauder contract. But as long as Lauder keeps a tight rein on Zegna and Marcolin, and doesn’t let the Tom Ford name be attached to too many new product categories (à la the ill-fated Halston), they’ve built a machine that can boost its bottom line for many decades to come.