There was a meeting at FIT in the Fall of 2009 themed the CEO Roundtable. It was an urgent gathering of many of the major CEOs in the retail industry to discuss the horrific crisis of the financial and economic collapse at the beginning of the Great Recession. Retail leaders were hoping for any help they could get. Calling it a CEO Roundtable was a rather bland title; it should have been called the CEO Crisis Summit, or something like that. The idea for this meeting was created by Gilbert Harrison, founder and former CEO of Financo. This initial Roundtable gathering would continue twice a year over the next decade. I participated by opening the meetings with a brief state of the industry to establish context for the discussion, and Eric Hertz, CEO of Center for Executive Development, helped to facilitate the conversation.

That Was Then

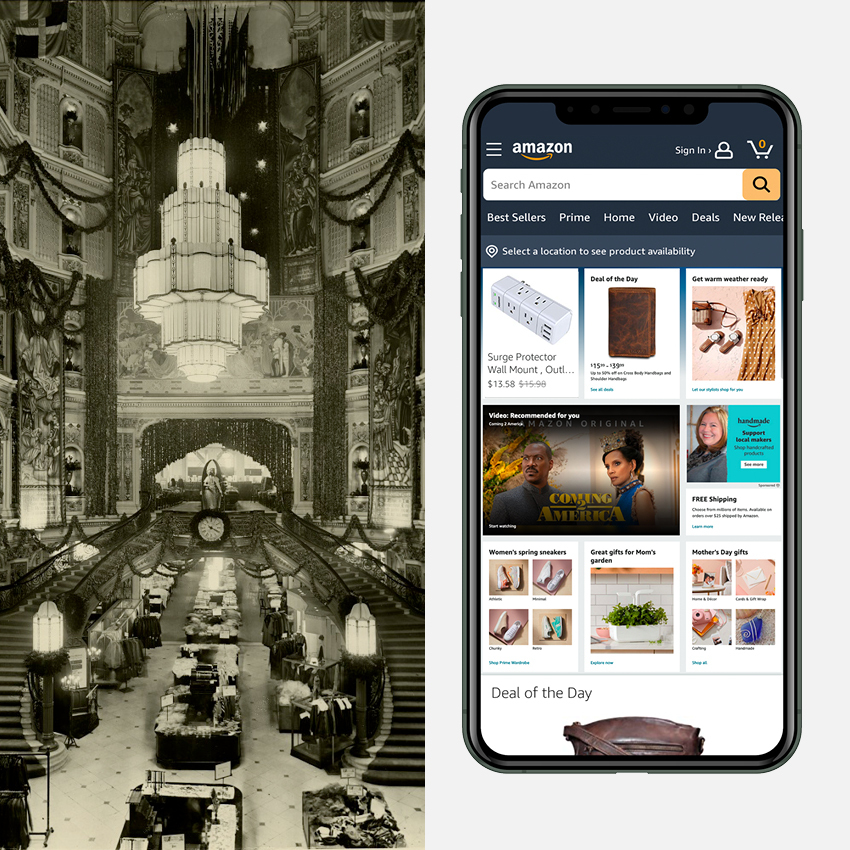

The reason for that 2009 Roundtable was that financial collapse almost brought the economy down and retailers occupied the horrific \”front lines,\” so to speak, as consumers quickly closed their wallets. And if the Fall of 2009 wasn\’t enough of a tsunami, at that point industry CEOs didn\’t even see tsunami 2.0 on the horizon: the full-on effect of the internet, led by the disruptor and destroyer-in-chief, Amazon. Tsunami 3.0, Covid-19, was incubating in the dark, totally unanticipated and unimaginable.

[callout]The result of the pandemic, along with the dynamics and power of the internet, changed the industry forever.[/callout]

So, as the 2009 economy began to lurch back with the help of government stimulus, GDP growth was tepid at around 1.5 to 2 percent, which would continue pretty much through the following decade. The retail industry, which had been overstored for half a century even before the economic crisis, was struggling for growth in a stalled economy. Amazon, on the other hand, was growing 20 to 30 percent a year, leading thousands of other new internet players. Of course, the combined growth of Amazon and the other newbies were stealing their enormous growth out of the hides of the legacy industry.

And This Is Now

So, during those years from the beginning of the Great Recession leading up to 2020, business was tough enough. And then tsunami 3.0/Covid-19 arrived out of nowhere, an invisible power that stopped the global economy in its tracks.

The result of the pandemic, along with the dynamics and power of the internet, changed the industry forever. First of all, the combination of the internet, a new young generation of consumers and the pandemic literally wiped out hundreds of weakly performing malls and thousands of physical retail stores, many who had deadly debt levels. These retailers also had not pivoted quickly enough following the financial crisis of 2009 to invest in the technology to build a seamlessly integrated online and physical omnichannel model. The retailers who did invest in transforming their models survived the economic fallout of the pandemic and will continue to thrive.

Five Strategic Imperatives

Going forward, there are five strategic requirements for success:

- Omnichannel; the seamless integration of all channels. This applies not just to physical retailers building online channels, but also to Amazon and other online players who must build out physical channels. As evidenced by Amazon\’s initial tests and forays into physical channels, it is much more challenging and requires huge capital and bigger time investments than it does for the brick-and-mortar players to build their digital channels.

- Agility in capital letters, across all functions of the business. Consumers\’ shopping behavior has been empowered by total accessibility (enabled by technology, which is advancing at a meteoric pace). All consumer-facing businesses must be agile to pivot or to leap to another level (also enabled by technology) at a rapid pace. Superior skills in AI and data analytics will be required to manage the re-engineering of retail.

- Convenience and speed must be built into both online and offline channels. Amazon ignited consumer expectations for speed and convenience. This, in turn, forced the brick-and-mortar channels to launch small, neighborhood store strategies. And the online players had to move offline into physical locations. Smaller neighborhood stores are closer to the consumer and double as shopping channels and distribution centers. The demand for quick and easy is also driving retailers to provide buy online/pick up in store, buy online/pick up in parking lots, and buy in store/have it delivered. Or as we saw on a new explosion during the pandemic, third-party shoppers do the shopping and deliver the order to consumers\’ front doors. AI and data analytics are basic tools required to identify the most productive locations for small stores, as well as reveal consumer characteristics for products and services that best align their preferences with the store brand.

- Experiences and \”platforming.\” Next-gen consumers need a big compelling reason to go to a store. Why would they spend the time it takes to go to, and shop through cavernous buildings or malls? These are places young consumers neither need nor want. And experiences differ greatly, depending on consumers\’ expectations of the brand. Lululemon\’s customer experience directly aligns with the brand\’s yoga and holistic fitness persona. Costco and TJX are treasure hunts. Trader Joe\’s is for affordable fun. You get the point. And getting the experiences right requires a great deal of AI and data analytics skills (are you seeing a pattern here yet?).

Platforming, as I have been defining it is a stage that retailers use, whether its physical square footage or online \”endless aisles.\” Simply, your brand and what it stands for can share your platform/space with an endless number of other brands offering a synergy of brands preferred by the same customers. For all the brands who get this, it provides an endless number of distribution points. - DEI, sustainability and social issues must be authentically embedded in models for success. The most powerful consumer cohort of next-gens are demanding that retail brands take a stand. Since the industry is still so overstored, if a retailer is not embedding these values into their business, the customer will simply walk out your door and cross the street to one that does. Or, they will find one that is just a key tap away.

What\’s the Point?

First of all, the old world of retail as we knew it was wiped out (literally) over the past 10 years. The survivors have been totally transformed. How? They practiced these five strategies for success.

The survivors made it through the Great Recession and its slow and sluggish recovery, along with pressure from Amazon and the internet players stealing chunks of old-world business.

They also understood consumers, including the strongest new cohort of next-gens, armed with technology (namely the smartphone as disruptor in chief) and a whole new set of entitled behaviors and values.

This is why these five strategies were and still are so necessary.

Pause, Assess, Activate

A final note suggests that you pause (step back from your jam-packed days) and deeply assess all five points and how your business aligns with them. Immediately activate solutions if you\’re not practicing any of the five imperatives. And accelerate what you are doing right.

If the last decade ended in the blink of an eye with the perfect storm (the economy, technology, civil unrest and the pandemic), the next decade will race by even faster and force more change.

So, if you want to be on the right side of history, get your house in order now!