Retail has never seen an event quite like Shoptalk. If you\’re responsible for innovation and transformation in your organization and you weren\’t part of the community of almost 8,500 strong at Shoptalk last week, you were conspicuous by your absence.

A Brief Overview

The esteemed former CEO of GE, Jack Welch, once said, \”If the rate of change on the outside exceeds the rate of change on the inside, the end is near.\” This message was threaded throughout and roared to the top of the takeaways from Shoptalk 2019. It speaks to the existential threat to every consumer-facing industry. Simply put, technology-armed consumers and their rapidly rising expectations are outpacing many retailers\’ and brands\’ rate of change to satisfy those expectations. Facing the possibility of failure, the need to become aggressively proactive, rather than reactive to change, was palpable. And \”aggressively proactive\” as the operative term screams the need for radical thinkers and doers to drive fundamental, as opposed to incremental, change. Plus, there is no time for pause. Urgency and speed described the mood in every session of the four-day event.

And by the way, even though most of the tech-driven startups were created by and are now being run by unleashed radicals, their need for urgency and speed is no less imperative than the legacy world. They are mostly venture funded, and their investors have one thing in mind: for these newbies to get big and profitable fast.

Once again Shoptalk did not disappoint in providing a comprehensive education and industry-wide collaboration on all fronts. First of all, Shoptalk is not just any events or conference company. The Shoptalk model includes building a community and powering it with sophisticated and proprietary technology that enables learning and collaboration, including more than 10,000 curated onsite one-to-one interactions. Having experienced Shoptalk firsthand every year for the past four years, I have to agree wholeheartedly with CEO Anil Aggarwal\’s opening statement that \”Shoptalk is not just any event-it\’s a new generation of events that takes a proactive role in moving the needle by bringing the right people together for the right conversations at the right time.\” Retail has never seen an event quite like Shoptalk, and Shoptalk 2019 was the best yet.

Shoptalk on Site

Shoptalk introduced another innovation this year, an Annual Retail Education Certificate which is awarded each year to every individual who completes at least 10 credits of approved continuing education at Shoptalk. This is critical at a time of such a significant divide in those creating the future and those watching from the sidelines. Every session at Shoptalk, including the mainstage keynote speakers, provided answers and solutions for the most vexing challenges for old- and new-world retail models as well as offering a multitude of technology-infused opportunities. There were lots of women leaders as presenters and keynoters this year: over one-third of the total, which is a start, since women make more than two-thirds of the shopping decisions in the industry. The persistent presence of older white guys in traditional retail has, in our opinion, been a huge part of the reason for sclerotic change.

There were five major themes based on Shoptalk\’s overarching theme, Create the Future of Retail:

1. Next generation retail experiences and technologies transforming the shopping experience

2. The new retail organization: omnichannel

3. Marketing and today\’s new consumer: understanding shoppers

4. Logistics and supply chain: advances in the last mile

5. Technologies transforming retail in store

Three Phases of Transformation

Below are three key strategic phases of transformation, the third of which we are now in. Shoptalk has been a principal leader in guiding the industry through the latest phase of this transformation. And now of course, its strong leadership is now more important than ever. This transformation relates principally to legacy retail and brand sectors simply because their challenges are much larger and more complex than those of the innovative, tech-driven startups. The startups operate out of the gate on a higher level of understanding of how to measure new, young consumers\’ behavior and how to use deep knowledge to optimize experiences and meet expectations.

1. \”Shock and Awe.\” The legacy world was in early-stage panic of being wiped out by e-commerce, (late 1990s – early 2000s)

2. \”The Awakening.\” During this period (mid-2000s to roughly 2010), the industry woke up and realized that brick and mortar could survive and might even have a competitive advantage operating on both digital and physical platforms. This was also a technology learning phase when retailers figured out what needed to be done and then began building the strategies for implementation.

3. \”Doing It.\” Beginning circa 2010, the industry began executing, albeit slowly. Those who were not yet in this phase were dead men walking; those who are in it must press the pedal or they will also fade away.

Five Barriers to Transformation

There are five major barriers to the transformation retail requires to be sustainable in the digital commerce marketplace.

- A mindset locked in and trapped in the definition of a \”retail store\” as a brick-and-mortar building that sells stuff.

Throughout Shoptalk, we heard the word \”platform\” (physical and digital) describing a model replacing the \”store.\” Helena Foulkes, CEO of HBC, described the concept in her keynote presentation as did Marc Rosen, President of Direct-to-Consumer, Levi Strauss & Co. The perfect platform of the future seamlessly integrates physical and digital entertainment and experiences with distribution. Does the Amazon \”platform\” come to mind (certainly not a \”retail store\”)? Their experience is convenience, value and speed. Will Hudson Yards in New York fit that description, as one giant platform/community, full of entertainment, experiences and a mega-shopping and distribution destination, where young consumers might want to hang out all day, as they once did in the now-dying malls? - Unenlightened, risk-averse leadership.

Leaders who are mentally stuck in the \”retail store\” mindset and all of its strategic and structural processes are not creating the future of retail. Those who reinforce \”This is the way it has always been done. We just have to do more of the same, but better,\” are losing the race to the future. Shoptalk advocates a collaborative, cross-disciplinary leadership model that uses systems thinking solutions inviting everyone to have a seat at the table. - Antiquated, sclerotic cultures built over a century that do not adapt to the arrival of the digital world and e-commerce.

In almost every session across all themes, there were comments about cultures not embracing technology-driven new processes, strategies and structures. C-level executives from Albertsons, The Hershey Company and John Hardy emphasized culture clashes within their organizations between the emerging new culture and those stuck in the past. And, acknowledging slow progress on all fronts of the transformation, they suggested more and faster education from the leadership was needed–they also stressed the benefits their employees would realize. - Lack of sufficient capital to transform.

The capital investments needed to transform will be gargantuan. Retailers must acquire key technologies, build out a seamlessly integrated, de-siloed, omnichannel offering, and replace the physical store of the past with the technology-infused platform for the future. For the large, publicly owned legacy retailers and brands, the pressure is enormous as Wall Street breathes down their necks. Those already carrying heavy debt loads are at risk of failing just by not having enough capital for change. - Lack of urgency and speed.

Speed was emphasized by all players–legacy and newbies alike–during Shoptalk. And like culture, there was not one session out of the hundreds over the four-day period, where urgency and speed were not literally emphasized by all players, legacy and newbies alike. If not literally discussed, intense urgency was in the air.

The Big Picture

Here\’s the rock-bottom spoken and unspoken message from Shoptalk: All five of the barriers must be overcome. There is no option. If there is not a radical mindset shift, failure will follow. If leadership is not able or willing to drive radical change throughout the entire model, failure will follow. If antiquated cultures are not radically transformed, failure will follow. If leadership doesn\’t have the stomach or the resources to make radical investments for change, failure will follow. And if the organization does not adopt a radical sense of urgency and speed–yet again, failure will follow.

Shoptalk provided a platform for thousands of thought leaders, C- and senior-level operators from hundreds of major legacy retailers and brands, and hundreds of owners and entrepreneurs of tech-driven startups, to provide an education with actual examples of how to overcome those five barriers. As I pause to think about the enormous necessity for the legacy world to overcome not one, but all five of these barriers, and the fact that there are real solutions provided at Shoptalk, I can\’t imagine why every CEO is not sending their senior-level teams responsible for innovation and transformation to the event. Unfortunately, some have not. In my opinion, given that Shoptalk was built as an educational and collaboration platform–and that it is determined to continue to elevate it–it\’s a big mistake not to have key management teams either in attendance or as active participants. The time has come when you are conspicuous by your absence at Shoptalk. The events your teams attend now speak volumes of who you are.

Two Mindset Considerations

Consumers, Brands, Marketing and Retailing \”101\”

The principles of commerce have not changed, but the tools for strategizing and implementing them have. The tech has advanced exponentially enough to totally extract the past commercial landscape and replace it with a strategic and structural landscape that we are just now getting a glimpse of. Initial elements are popping up in different ways, through tech-driven startup models and the beginning of radical changes surfacing in some of the legacy models. A new language is even emerging, driven by technology, with new terms and definitions. All of it is being propelled by the tech-armed young consumers, whose expectations and demands continue to ratchet up. The existential danger for the legacy world is that if they don\’t shift from being reactive to being proactive, they will die. Urgency and speed are a top priority.

Consumers as POS (Point of Sale) Wherever They Are

In my opinion, the single most disruptive shift in commerce was, and is, being driven by the tiny mobile device called a smartphone, which incredibly houses the largest marketplace in the world. Essentially it blew up the entire value chain of every consumer-facing legacy retail model, from sourcing all the way through consumption. The old forecasting-driven linear value chain is extinct. It consisted of guessing what consumer demand would be at the end of a year-long production and distribution cycle. The linear process begins with production, then delivery of product to warehouses where it sits until it\’s needed in the store, where it finally sits until the consumer finally buys it. Does anyone need to wonder why this antiquated value chain sent about $500 billion worth of excess inventory into landfills and on barges to developing countries in 2018?

Consumers are now the POS, demanding unlimited and instantaneous access to whatever their hearts desire, wherever, whenever, how and how often they want it delivered — in a frictionless, personalized, experiential shopping journey, delivered in a nanosecond, to boot. This requires a demand-driven value chain, seamlessly integrated online and off, that in its perfect state, triggers production/creation only when demanded. Since each consumer is the POS, there are a multitude of fluid supply chains, long and short and big and small, quickly and efficiently delivering the purchase directly to the POS wherever they are. This also drives inventory optimization. AI, machine learning, along with other supply chain technologies are making this possible. Personalization, localization, and the demassification and the long tail of fragmented smaller, intimate neighborhood platforms will provide the physical experience whenever and wherever the consumer decides to be his or her POS.

Things We Loved at Shoptalk

- Raissa Gerona of online fashion site Revolve spoke about her company\’s entry into events, with hot-ticket parties in LA and sponsorship of influencers at Coachella (their Hotel Revolve pop-up lured 1200 people, including 500 influencers, and generated millions of new followers on Instagram) to reach customers in the most organic and authentic way possible, not hiding at all the fact that they\’re trying to sell more clothes: \”We\’re a commerce company doing content.\”

- Andrea Fasulo of TV network Nickelodeon\’s licensing and sponsorship said: \”We\’re a content company doing commerce.\” Case in point: Nickelodeon has a sponsorship deal with now 15-year-old influencer Jojo Siwa, who has 7.9 million followers on Instagram, a fashion collection at Target, an accessories deal in which Claire\’s sold 50 million Jojo signature hair bows (far more than the total population of Canada), and a doll at Walmart that outsold Barbie.

- Helena Foulkes of HBC: \”You need to fail fast, and fail cheap. If we\’re setting up tests, and don\’t have some failures, then we haven\’t pushed far enough.\”

- Ben Silbermann, Co-founder and CEO of Pinterest, said: \”You need to give people inspiration, help them in discovery. Brands and companies are the bridge between people and action. Shopping is an emotional experience. Shopping is not necessarily buying.\”

- Chobani VP of eCommerce Michele McNamara: \”If you are able to connect on an emotional level, your consumer is willing to pay a premium. We can release something in days, where it takes bigger food companies years. You can\’t operate on fear of disrupting yourself.\”

- Marc Rosen, EVP and President of Direct-to-Consumer for Levi Strauss & Co., and The Robin Report 2019 Radical of the Year, is driving major shifts across the DTC business. Starting with his mindset shift from store to platform, he has taken personalization to another level and elevated voice commerce with Indigo, a chatbot Rosen innovated.

- Matt Judge, North American Regional President, Eight Inc. said, \”Consumers do not live in channels.\”

- Physical retailing spaces need to be more than just places where people buy things. \”Building a community and cultural hub\” is key, said Ryan Babenzien, CEO of Greats.

- Panera has become a leader, not just in casual fast food, but in retail overall, in offering multiple ways for its customers to interact with it when they are ordering. Mark Berinato, VP, experience design, says the company\’s \”use of technology allows it to create custom experiences\” for its customers including grab-and-go, fast ordering, leisurely ordering, served by a server, delivery, order online/pickup in store

- Sharon Price John, president and CEO, Build-A-Bear described how a few years ago the company had 500 nearly identical stores, located in shopping malls, with essentially the same merchandising strategy. As malls started to close and traffic declined the company realized it needed \”the solution for the failing malls\” or it would in serious trouble. So, it began a diversification program to open multiple formats in non-mall locations, including shop-in-shops in stores like Walmart, FAO Schwarz and Cabela\’s and places like on Carnival Cruise ships.

- Roger Rawlins, CEO of DSW, said they were focused on three points: Gaining significant market share, differentiated product and differentiated experiences. To get to those places, the company is doing several things: Testing a Nail Bar salon which could eventually roll out to 200-300 locations, engaging in shoe repairs and acquiring the Vince Camuto brand to create its own private brands. Private label is 10 percent of the biz, and we expect it to \”grow significantly.\”

- Billy May, CEO of Sur La Table on in-store experience and brands: \”Personalization is good but relevancy is a reality.\”

Things That Surprised Us at Shoptalk

- Barbie just turned 60. How did that happen? President and COO of Mattel Richard Dickson said Barbie has been a role model for purposeful play for decades closing the dream gap and bringing empowerment to young girls who feel they don\’t have the same choices as boys. He reported that \”We changed Barbie\’s body, which was a huge step.\” The result? Sales increased 15 percent year-over-year. Margot Robbie (not surprisingly) will appear as Barbie in a major motion picture in production.

- Facial recognition is 99.8% accurate and will make credit cards and ATM cards obsolete. Peter Trepp, CEO of FaceFirst said current applications of facial recognition are public safety and surveillance. He said facial recognition is so accurate because \”No one can steal your face.\” Yet.

- James Crawford CEO of Orbital insight uses satellite feeds to track cars in parking lots and customer traffic (through smartphone pings) to advise retailers on metrics to help them better correlate data to potential sales.

- Erik Huberman of Hawke Media commented that the cost of digital marketing increased 150 percent in the past year-which explained why everyone, from digital native startups to heritage brick-and-mortar retailers, become more fixated than ever on the customer.

- Cathey Curtis of surf-swim brand Billabong said they switched from models to athlete influencers to share and connect with consumers and become a community of like-minded people. With more authentic voices in the surfer lifestyle space, they got three times higher engagement and saw huge increases in revenue and global interest.

- Stewart Landesberg of Grove Collaborative, the CPG company for the next generation, is out to transform the $2 trillion non-food consumer products industry by recruiting families to shop online for non-toxic, sustainable products for the home. Grove\’s concentrated laundry detergent, which comes in a pouch and is mixed with water into a reusable container, saved 100K pounds of plastic and countless gallons of fossil fuel. He commented that \”If you preach to the choir, you don\’t get too many converts.\”

- Companies are increasingly using B2B corporate communications platforms like Slack to communicate with consumers. E.l.f. Beauty VP of Innovation Ellie Off said social listening is a hugely important way to communicate with consumers. \”Be open to feedback, it\’s a gift. You are the magazine of today.\”

- Moiz Ali, Founder and CEO of Native Brands, the natural deodorant brand launched on his dining room table, found success by focusing on his consumer and testing and iterating EVERYTHING. He merges data usage with a human element to personalize customer experience. \”We only focused — maniacally — on our consumer. We were very data-driven, ran Facebook ads, testing everything from headline to copy to whether the caption was in all caps or not. We tested stuff at the cart level – did a pop-up just before the end of the transaction, which actually increased conversion, which was counter-intuitive. As our customer base grew to tens of thousands, we even tested different product formulations. We have hundreds of variations of data, which allows us to test everything.\” On the flip side, Native makes sure that its interactions with consumers have a very human feel. \”When customers purchase, we send them an email saying we\’re popping bottles of champagne. It makes people feel like their buying from real people, not a ginormous conglomerate.\”

- The TV show \”Tidying Up with Marie Kondo\” by the best-selling Japanese neatness guru (who advocates getting rid of 65 percent of your belongings, keeping only those that \’spark joy\’) was cited as a cultural game-changer that is joyfully sparking a movement toward having and buying less stuff.

- In a mind-boggling, incredible presentation, Hans Tung of $6 billion VC fund GGV Capital (which has a strong focus on China) shared some amazing statistics and predictions. In the last five years, China online sales have grown from 10 percent of total retail, or $441 billion, to 24 percent of retail, or $1.3 trillion. There are now 185 unicorns in China, compared to 156 in the U.S.

- Justine Chao of Alibaba said \”We have an acute knowledge of the limitations of e-commerce. We are very optimistic about physical retail in China. Many services are best offered in the offline space, where 76 percent of total sales are taking place. We can use what we know about consumers from our online data to transform physical retail.\” Alibaba is working with the six million mom-and-pop convenience stores in second-tier cities in China to upgrade store assortments, renovate the physical space, and use technology to improve customer interaction.

- Closing stores may not be that simple. Paula Price, CFO of Macy\’s, said when Macy\’s closes a store, online orders from that area actually decline. \”We know there\’s a relationship between having a store and online sales. The bulk of the Macy\’s store fleet are neighborhood stores which are important as distribution points for online sales. Closing them involves more than just looking at sales per-square-foot. That said, sales per-square-foot as a measurement is not dead. It helps Macy\’s to measure certain things, such as for instance when a Backstage department replaces existing merchandising space. \”Real estate and retail go hand in hand.\”

- Maureen Sullivan, COO of Rent the Runway, said that the average woman buys 68 apparel items a year, but 80 percent get worn only once (that\’s 54 items). Research has revealed that there is a pragmatism among these consumers who want access rather than ownership. She said, \”15 years ago women spent 2.5 percent of take-home pay on clothing, now it\’s 6.5 percent.\”

- Mike Smith, COO of Stitch Fix, pointed out that AI and machine learning can only go so far in personalizing apparel recommendations. It requires an equal mix of human styling for which they have 4000 stylists.

- Dollar Shave Club\’s surprising and provocative video about men\’s grooming without the veneer of Photoshopped male hero fantasy imagery.

- GPS-enabled app, Curbside, monitors where customers are and when they are arriving minute-by-minute to pick up online orders, according to Jaron Waldman, CEO and founder.

- Artificial Emotional Intelligence is emerging. According to Keren Zimmerman, Co-Founder & CEO of Personali, 80 percent of purchasing is an emotional decision. Technology measures emotions through a combination of facial recognition and machine learning, enabling retailers to drive even deeper personalization.

- Americans spend 37 billion hours a year standing in line to check out. According to Tarang Sethia, VP Product Management, Digital Customer and Store for 7-11, cashier-less stores are the future, which 7-11 is now working on. So are Build-A-Bear and Sam\’s Club.

- Erik Nordstrom, co-CEO of Nordstrom, reports the New York City store, opening this year, \”is the biggest investment the company has ever made. Our stores are a long-term investment and we continue to believe New York is such a vibrant retail market.\” And the most popular aspect of Local, the showroom test store in LA, has been customer returns, order pick-up and alterations.

- Nilam Ganenthiran, chief business officer for Instacart said \”In the next three to five years, one in five grocery purchases will be online.\” And on the topic of speed, he said: \”Test fast, scrap what doesn\’t work and double down on what does.\” Direct to consumer is NOT just ecommerce – it is also brands having their own branded stores like Levi.

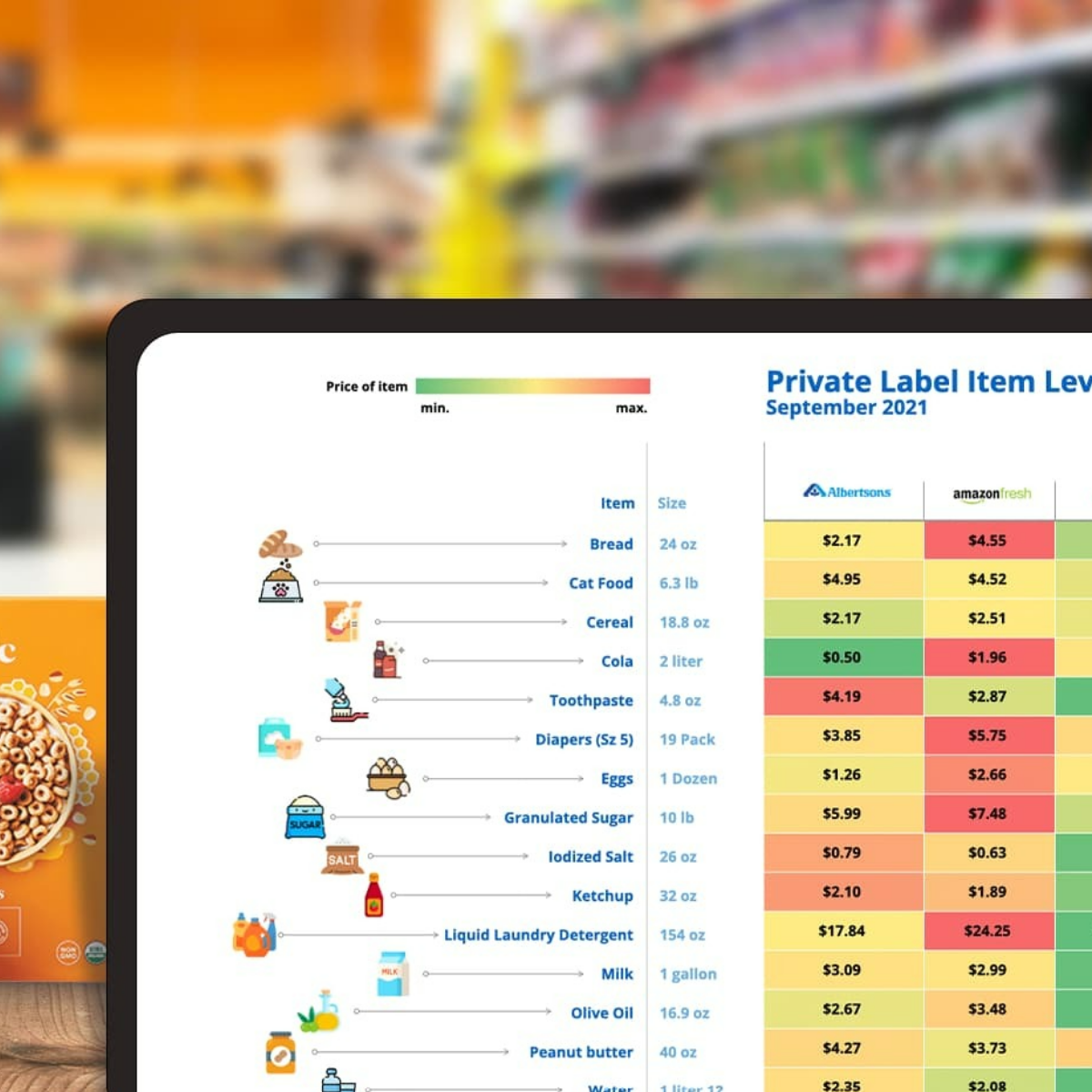

- Brands, including private ones, are not dead and remain very important, including to millennials, said Gil Phipps, VP Branding, Marketing & Our Brands for Kroger: 92 percent of Kroger customers shop its private brands, 80 percent of millennials are loyal to brands and \”private label is a compelling reason for customers to come to our stores.\”

- Disruption is subjective: Tuft & Needle, one of the original disruptors in the mattress category, has gone big time into distribution with the very stores it said it was disrupting: Amazon, Lowe\’s, Walmart and its own stores. It went so far from its origins that it was bought by Serta Simmons, one of the two giant legacy mattress suppliers. JT Marino, co-founder of the company, justified all of this by saying \”For us to be disruptive we have to be big and we want to bring disruption to completion.\” Our opinion: bull, total nonsense. They have become everything they said they were trying to disrupt.

- Dirty Lemon/The Drug Store is another example of a DTC seller that started out with one business model and, having realized its limitations, is pivoting. They began selling juiced beverages online, primarily through Facebook and Instagram but have now moved to marketing their products through new channels including bars. The company has stopped Facebook and Instagram completely (they were spending $20-$30K a day in total on social media), due to the high cost of customer acquisition through these media vehicles.

- Glamsquad cut back on social media due to customer acquisition costs and are trying other vehicles like podcasts. Ian Friedman, co-head, Goldman Sachs Investment Partners: \”CAC – customer acquisition costs\” – is the new rent.\”

- Data is important but not the be-all and end-all. David Katz, EVP and Chief Marketing Officer of Randa Accessories (and a 2019 Radicals Awards Finalist) said \”All data is historical backwards data. It doesn\’t predict what would happen if we change something.\”

- JuE Wong, CEO of Morcoccanoil, on why she chose to sell her products on Amazon: \”By selling on Amazon we can use them to stop counterfeit products. Partnering with them protects us. Learning to work with them is better than fighting them.\”

- Marvin Ellison, CEO of Lowe\’s, started as a security guard. On coming to a new company, he advises: \”We had a saying in our family, \’God gave you two ears and one mouth for a reason.\’ If I\’m coming to a new company, I can\’t solve anything until I understand the culture and the problems.\” On what it was like to be the \”only one\” (African-American) so often in his career, he said \”At the beginning, I thought blending in was the answer. I found out over time that the real answer was not to fit in, but to stand out. Be yourself. Don\’t be a commodity-it\’s low-priced and easily accessible. Be the only one. It\’s a more powerful and valuable place to be.\”

Things We Wished We\’d Heard More About

- How will blockchain evolve, particularly as young consumers demand to know more about where the product is made, under what conditions and with what ingredients?

- How will virtual reality become a more significant sensory experience in the purchase process?

- When 3D printing becomes accessible to every household, and the consumer becomes the prosumer (producer and consumer), who needs a store, physical or online?

- With data as the new oil, how do you value this intangible?

- What are all the issues around transparency, security and privacy that are being driven by the data stream economy, and how will they be dealt with in the future?

- How will GenZ change retail, in particular with an intuitive sense of the relationship between man and machine? Will retail be as unprepared for Gen Z as they were for millennials?

- Who is taking an authentic stand for sustainability and what is the industry doing about the excess of packaging, particularly the waste stream of Amazon cardboard boxes?

- What are some of the best-practice use cases on listening to the consumer? There was lots of talk about data, but no clear strategies on how to do it and no evidence that any brand or retailer is really using it.

- What effect will the burgeoning industries in cannabis and sports betting have on retail?

- Where will the inclusive marketing and micro-movements around diversity, size, LGBTQ and others, that are potential culture changers, end up?

- How can retail organizations drive new revenue streams through sales of its data?