After a lengthy period of topside executive turmoil, Sprouts Farmers Market recently landed a new chief executive officer who will have his hands full with challenges facing the supermarket chain. Jack Sinclair, was appointed CEO after his predecessor suddenly resigned last year. In the interim — an unusually protracted time — the company was guided by a couple of officers until Sinclair was brought in.

Sinclair joins with a substantive portfolio. He was CEO of 99 Cents Only, had a lengthy stint as executive vice president of Walmart\’s U.S. grocery division and executive positions at food retailers in the U.K. In all, he has some 35 years of experience, which he will need as he takes on Sprouts\’ challenges.

Inside Sprouts

Sprouts operates more than 330 stores, which average about 30,000 square-feet. They are well appointed and attractive stores, heavy on fresh, organic and natural product along with bulk goods, delis and bakeries. Service levels are high, which equates to high labor costs. The stores produce a top line of nearly $5 billion, but profit margins are quite thin and same-store-sales are barely moving the needle. In sum, Sprouts isn\’t a basket case, but it\’s underperforming and certainly should be more financially productive than it is.

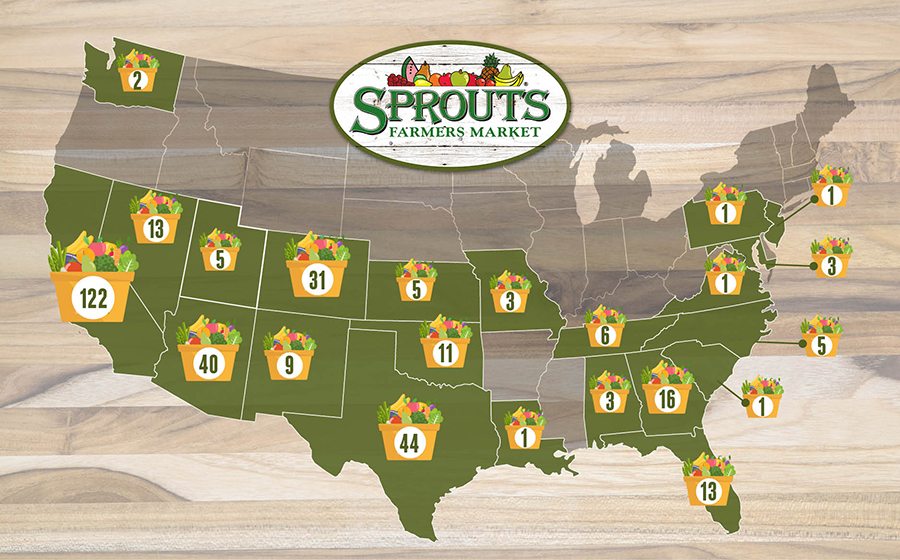

The biggest reason behind the lackluster performance metrics is how geographically widespread Sprouts stores are. For instance, there\’s only one store in each of the far-flung states of Louisiana, New Jersey, Pennsylvania, Virginia and South Carolina. There are just two in Washington state and five in each of Kansas, Utah and North Carolina; 13 in Florida, and so on.

Its highest store count is in California where there are 122 stores. That\’s more efficient, but California is a big place, as is Texas where there are just 44 stores. Even in its home state of Arizona, there are only 40 stores, which is its best density profile.

Density is Destiny

Density is destiny in the supermarket industry, because without density it\’s necessary to develop product-supply relationships in many different locations, which is complex and labor intensive. In a bid to ameliorate some of that problem, Sprouts has entered into a supply arrangement with KeHE Distributers, a natural and organic product supplier based in Illinois. By the way, Sprouts has no stores in Illinois, but luckily KeHE has distribution depots fairly close to numerous Sprouts locations.

The wholesale-supply arrangement will help with logistics but won\’t do much to solve other problems caused by insufficient store density, such as high localized marketing costs, labor costs and so on. Product-acquisition costs will remain high too since distributors need to make a profit just the same as retailers do. Beyond that, there\’s a lot of product in a Sprouts store that the distributor can\’t supply. In the end, price points will remain high even as competitors are burgeoning.

Density Alternatives

Sprouts is far from alone in grappling with the problems associated with lack of density.

For quite a while, the similarly positioned Whole Foods grew rapidly and opened stores across a wide landscape. At the time, Whole Foods was the only chain around offering specialty, natural and organic product, so it could command very high price points, camouflaging its inefficiencies.

Whole Foods\’ financial performance deteriorated markedly as competition grew, then it was financially rescued by the Amazon buyout two years ago. Amazon doesn\’t break out Whole Foods\’ financials, but it\’s likely that it remains challenged in terms of profitability.

Of course, there are chains that lack density, but still do pretty well. Chief among them are Trader Joe\’s and Aldi. Both depend almost entirely on private brands. There are scores of manufacturers across the land who can supply private brands, so the cost of that form of business is low in terms of product-acquisition costs. Moreover, these stores are small and operate with few employees. All that equates to low price points, a pretty good niche to occupy.

The Road Ahead

So, we\’ll see how Sprouts\’ new CEO tackles the problems the chain faces. But, at least, he seems to have just the right resume to do so. Most obviously he could consider divesting or closing stores that are orphaned by geography. If that\’s not sufficient, the entire chain, or much of it, could be sold so it could be integrated into a much larger company. There are rumors that Albertsons had its eye on Sprouts a while back, but nothing worked out. Maybe something like that should work out in the near future.

As for how Sprouts\’ situation relates to other styles of retailing, Sprouts shows once again the need to own a niche and to clearly articulate that positioning to customers. But that niche can\’t come at the cost of operational inefficiencies. As Trader Joe\’s and Aldi show, that niche can be as simple as ultra-low prices. If not that, then retailers must show a powerful non-price proposition that competitors can\’t match. And that is also the challenge for fashion retailing.