Department stores have been on an inexorable slide into oblivion over the last decade. Since 2012, department store sales, excluding discount department stores, have declined nearly 50 percent, dropping from $63 billion to $32.4 billion in 2022, while retail overall advanced 65 percent. Notably, no other sector in retail experienced a rate of decline so high.

It’s no surprise that a big chunk of those dollars went to online retailers with their sales more than tripling in the decade, from $408 billion to $1.3 trillion. General merchandisers classified as “other,” including warehouse clubs and superstores, experienced about a 50 percent uptick in sales reaching just under $700 billion. And furniture and home furnishing stores grew by nearly 60 percent to $144 billion.

In the past ten years, Macy’s, was the category loss leader, with sales dropping from $28 billion in 2012 to $24.5 billion in 2022, a 13 percent decline. Kohl’s did a bit better, dropping only 4 percent, from $19.3 billion to $18.5 billion in 2022, with a slight increase in the number of stores, from 1,146 to 1,165.

Dillard’s was able to reverse the trend, but not by much, up 3 percent from $6.6 billion to $6.8 billion in 2022. And Nordstrom racked up the greatest gain, growing by 28 percent from $11.8 billion in 2012 to $15.1 last year, but most of it was credited to its discount Nordstrom Rack banner, which doubled revenues over the decade to reach nearly $5 billion in sales.

Given the headwinds the department store category faces, it was a surprise to see Macy’s, Nordstrom, along with other department store stalwarts Belk, Neiman Marcus and Saks Fifth Avenue ranked among the top 15 retailers in a unified commerce report from Manhattan Associates.

The study conducted by Incisiv looked across 124 retailers in 11 specialty retail segments. It found only 15 companies as leaders in unified commerce where in-store and online experiences were seamlessly linked. And among those leaders, department stores stood head and shoulders above the rest, capturing one-third of the top slots.

One wonders how far behind department store retailers would be if they hadn’t leaned into omnichannel so effectively over the last decade.

Many department stores have been in business for over a century, ranging from 1858 when Macy’s was founded to Neiman Marcus in 1907. They’ve stood alongside customers throughout the many changes the world has undergone throughout those years. At its core, unified commerce isn’t some new-fangled way of doing business, only bringing it up to date using 21st-century technical innovations to work for customers and in-store sales associates.

Legacy Retail and Unified Commerce

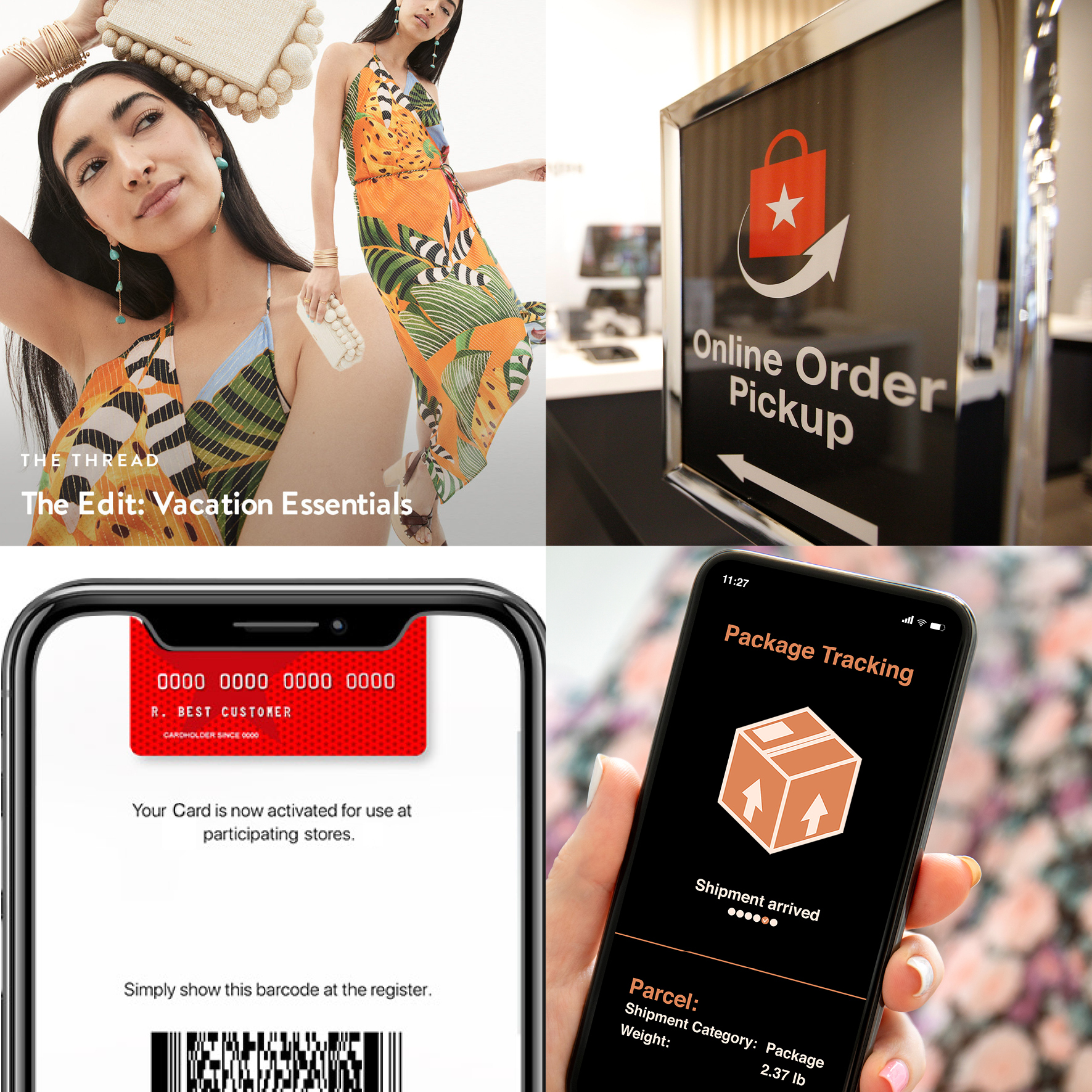

Uniting the In-Store and Online Experience

Recognizing that retailers have typically operated store and digital channels independently with different ecommerce and point-of-sales platforms, the research measured 286 customer experience touchpoints across four functional areas: search and discovery, cart, and checkout, promising and fulfillment and service and support. Researchers quantified the measures through five online visits per retailer at different times of the day and visited three stores in various locations. They also made eight purchases and returns to each retailer to replicate real customer journeys across digital and physical channels. Interestingly, a number of larger digital native vertical brands (DNVBs) were included in the sample, but they didn’t make the grade on the leaderboard. Besides the department stores mentioned above, other unified commerce leaders were Academy Sports, American Eagle, Crate & Barrel, Levi’s, MAC, Pandora, REI Co-Op, Sephora, Ugg and Zales. DNVBs excel in search and discovery reflected in product and brand storytelling and service and support, giving shoppers a variety of customer service options like 24/7 live chat, and returning store purchases online, but they fall down in promises and fulfillment. These capabilities include offering customers control of how, when and where products ordered are delivered.Digital Native Brands Still Have a Lot to Learn

Concluding that omnichannel and DNVBs have much to learn from each other, the research reveals that upstart DNVBs aren’t the disruptors they are made out to be when it comes to delivering a 360˚ unified customer experience. In fact, traditional department stores excelled at unified experiences. Each department store unified commerce leader has been in business for over a century, ranging from 1858 when Macy’s was founded to Neiman Marcus in 1907. They’ve stood alongside customers throughout the many changes the world has undergone throughout those years. At its core, unified commerce isn’t some new-fangled way of doing business, only bringing transactions up to date using 21st-century technical innovations working for customers and in-store sales associates. “When we reviewed the benchmark results, we were surprised by the strong performance of the department stores and the luxury department stores in particular,” said Ann Ruckstuhl , Manhattan Associates’ chief marketing officer. And she noted that Nordstrom was the only retailer in the whole study that nailed all four categories of capabilities measured. “Unified commerce technology promises a consistent and seamless omnichannel experience across all channels, whether they are shopping online, in-store or via phone,” she added. “Its goal is the seamless fusing of all channels to create a singular experience for the customer. The problem for many retailers is that a growing variety of selling, engagement and fulfillment expectations have made delivering those omnichannel commerce experiences increasingly more difficult.”Differentiating Experiences

Even with department stores so far out in front, Ruckstuhl offered four areas where they have room for improvement. Specifically, she calls out the need to move beyond table stakes – foundational capabilities required to address shopper expectations today – to experiences that will differentiate them tomorrow. Differentiating experiences are advanced capabilities that address shoppers’ emerging expectations.- Clienteling – Clienteling is the art of establishing a long-term relationship between the customer and the brand by using the science of technology and data to grease the wheels. It requires collecting many elements of customer data and then leveraging that data to create personalized brand experiences both online and IRL (in real life). For example, the study found only about 40 percent of retailers give store associates access to shopping purchase history and wish lists across all channels. In this capability, luxury department stores are ahead of Macy’s and Belk. Clienteling is characterized by guided inspiration, rich findability, and immersive storytelling and here UNTUCKit gets high marks for allowing its sales associates to provide virtual assistance in-store with digital tools to help customers find their look by occasion, weather, time and fit. Other differentiating clienteling opportunities can be found by offering wish lists and look books and allowing store associates to interact with customers via text and email.

- Added Flexibility – Delivering on promises made, i.e., fulfillment, and giving customers options as to where and how delivery is made is another differentiating capability. For example, customers should have the ability to change their fulfillment method after the order is placed; only 15 percent of retailers provide this option. “Department stores need more flexibility in terms of allowing last-minute online order modifications after confirmation, changing shipping destination or even delivery method, such as BOPIC to shipping,” she maintained. Belk is called out for being ahead in this capability, providing multiple fulfillment options – pickup for one item in an order and delivery for another. And Belk allows flexibility in delivery timelines for each item. Academy Sports and Sephora also offer similar flexible shipping options. For example, they allow shoppers who originally planned to pick up in-store to have an item shipped instead.

- Payment Options – Providing more payment options is part of the cart and checkout capabilities measured. A differentiating experience here relates to allowing multiple payment modes for one order and giving shoppers the option to pay however they prefer. That includes, buy now, pay later availability, easy redemption of loyalty points and gift cards, expedited checkout and the option for digital wallet payment. And payment options should be connected across channels through a unified cart so that customer purchase history and related payment data are available online and to in-store associates on their mobile device. Camping World is a leader in providing this capability. Aerie gets high marks for allowing customers to use a combination of multiple gift cards and credit cards to make payments. And Cuynana leads in the luxury sector by offering a single-step checkout where shipping details are carried over, and all payment-related information is entered in one step. Attention to frictionless checkout fights cart abandonment, both online and in-store. Requiring too many steps online and long wait times in-store create friction. Macy’s, Neiman Marcus, and Nordstrom are department stores that have nailed this capability.

- Post-Purchase Communication – Over 90 percent of the retailers studied provide order tracking for online orders; however, only 28 percent give real-time order status updates or alerts in case of shipping delays. Department stores tend to fall down here, with only 8 percent allowing delivery scheduling and last-mile tracking. “Proactive post-purchase communications in case of shipping and in-store pickup delays and the ability to track orders via email and text can help further strengthen customer delight and loyalty,” Ruckstahl said. Ultimately, the purpose of post-purchase communication is not the end of the customer journey. It should be the beginning of a deeper customer relationship. “The idea of a path to purchase is inherently transactional. It is linear with a beginning and an end. Brands that prioritize relationships over transactions should instead focus on building a ‘stream of engagement.’ They must design experiences that allow shoppers to move from one need state to another seamlessly and let them stop and start engagement at their own terms,” the report states.